Page 55 - Xperien ESG Report 2022

P. 55

Xperien.com

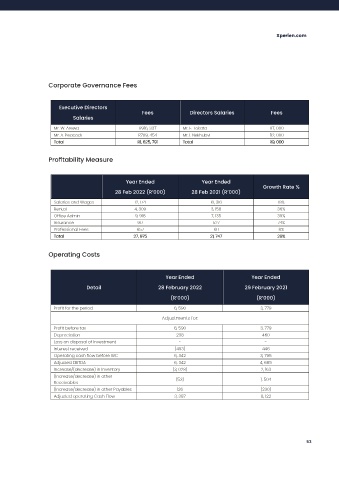

Corporate Governance Fees

Executive Directors

Fees Directors Salaries Fees

Salaries

Mr. W. Arewa R916, 337 Mr. E. Tokata R7, 000

Mr. A. Peacock R709, 454 Mr. I. Nekhubvi R2, 000

Total R1, 625, 791 Total R9, 000

Profitability Measure

Year Ended Year Ended

Growth Rate %

28 Feb 2022 (R’000) 28 Feb 2021 (R’000)

Salaries and Wages 12, 174 10, 316 18%

Rental 4, 309 3, 158 36%

Office Admin 9, 918 7, 135 39%

Insurance 917 527 74%

Professional Fees 657 611 8%

Total 27, 975 21, 747 29%

Operating Costs

Year Ended Year Ended

Detail 28 February 2022 29 February 2021

(R’000) (R’000)

Profit for the period 6, 590 3, 779

Adjustments for:

Profit before tax 6, 590 3, 779

Depreciation 238 460

Loss on disposal of Investment - -

Interest received (493) 446

Operating cash flow before WC 6, 342 3, 795

Adjusted EBITDA 6, 342 4, 685

Increase/(decrease) in Inventory (3, 028) 2, 163

(Increase/decrease) in other

(53) 1, 504

Receivables

(Increase/decrease) in other Payables 126 (230)

Adjusted operating Cash Flow 3, 387 8, 122

53