Page 161 - SKU-000506274_TEXT.indd

P. 161

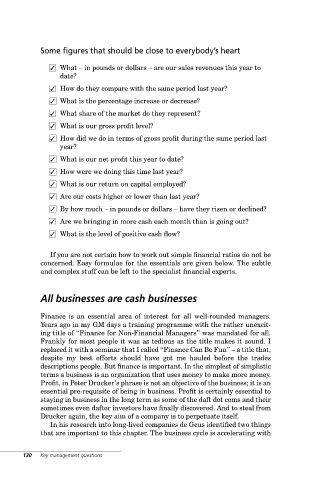

Some figures that should be close to everybody’s heart

What – in pounds or dollars – are our sales revenues this year to

date?

How do they compare with the same period last year?

What is the percentage increase or decrease?

What share of the market do they represent?

What is our gross profit level?

How did we do in terms of gross profit during the same period last

year?

What is our net profit this year to date?

How were we doing this time last year?

What is our return on capital employed?

Are our costs higher or lower than last year?

By how much – in pounds or dollars – have they risen or declined?

Are we bringing in more cash each month than is going out?

What is the level of positive cash flow?

If you are not certain how to work out simple financial ratios do not be

concerned. Easy formulae for the essentials are given below. The subtle

and complex stuff can be left to the specialist financial experts.

All businesses are cash businesses

Finance is an essential area of interest for all well-rounded managers.

Years ago in my GM days a training programme with the rather unexcit-

ing title of “Finance for Non-Financial Managers” was mandated for all.

Frankly for most people it was as tedious as the title makes it sound. I

replaced it with a seminar that I called “Finance Can Be Fun” – a title that,

despite my best efforts should have got me hauled before the trades

descriptions people. But finance is important. In the simplest of simplistic

terms a business is an organization that uses money to make more money.

Profit, in Peter Drucker’s phrase is not an objective of the business; it is an

essential pre-requisite of being in business. Profit is certainly essential to

staying in business in the long term as some of the daft dot coms and their

sometimes even dafter investors have finally discovered. And to steal from

Drucker again, the key aim of a company is to perpetuate itself.

In his research into long-lived companies de Geus identified two things

that are important to this chapter. The business cycle is accelerating with

130 Key management questions