Page 189 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 189

xv

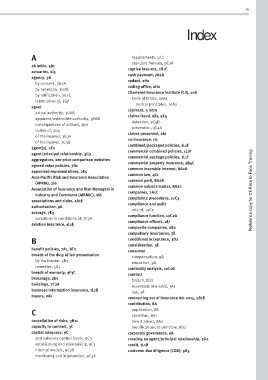

Index

A requirements, 9C2

standard formula, 9C2A

ab initio, 3A1

captive insurers, 2B1C

actuaries, 2I5

cash payment, 7A2A

agency, 3G

cedant, 2H2

by consent, 3G2A

ceding office, 2H2

by necessity, 3G2B

Chartered Insurance Institute (CII), 10A

by ratification, 3G2C

Code of Ethics, 10A1

termination of, 3G7

central principles, 10A2

agent

claimant, 3 intro

actual authority, 3G6A

claims fraud, 9E1, 9E4

apparent/ostensible authority, 3G6B

detection, 9E4B

consequences of actions, 3G6

prevention, 9E4A

duties of, 3G4

claims personnel, 2I2

of the insured, 3G3A

co-insurance, 1I1

of the insurer, 3G3B

combined/packaged policies, 1L1F

agent(s), 2E2

commercial combined policies, 1L1F

agent/principal relationship, 3G3

commercial package policies, 1L1F

aggregators, see price comparison websites

commercial property insurance, 5B4C

agreed value policies, 7D1

common insurable interest, 8A2A

appointed representatives, 2E5

common law, 4C1

Asia-Pacific Risk and Insurance Association

common peril, 8A2B

(APRIA), 2I6

common subject-matter, 8A2C

Association of Insurance and Risk Managers in Reference copy for CII Face to Face Training

companies, 2A1C

Industry and Commerce (AIRMIC), 2I6

complaints procedures, 10C3

associations and clubs, 2A1E

compliance and audit

authorisation, 9A

role of, 10C2

average, 7E3

compliance function, 10C2A

variations in conditions of, 7E3A

compliance officers, 2I7

aviation insurance, 1L1E

composite companies, 2B2

compulsory insurances, 5E

B conditional acceptance, 3D2

consideration, 3E

benefit policies, 7A1, 8F2

consumer

breach of the duty of fair presentation

compensation, 9A

by the insurer, 5D3

education, 9A

remedies, 5D1

continuity analysis, 10C1G

breach of warranty, 3F3C

contract

brokerage, 2D1

breach, 8D2

buildings, 7C2A

essentials of a valid, 3A1

business interruption insurance, 1L1B

law, 3A

buyers, 2A1

contracting out of Insurance Act 2015, 5B1B

contribution, 8A

application, 8B

C condition, 8A1

cancellation of risks, 3H11 how it arises, 8A2

capacity to contract, 3C modifications to principle, 8B2

capital adequacy, 9C corporate governance, 9A

and solvency control levels, 9C3 creating an agent/principal relationship, 3G2

establishing and maintaining, 9C1 credit, 1L1B

internal models, 9C2B customer due diligence (CDD), 9D3

monitoring and intervention, 9C3A