Page 190 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 190

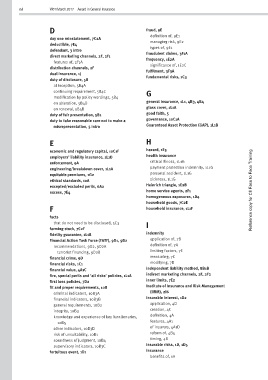

xvi W01/March 2017 Award in General Insurance

D fraud, 9E

definition of, 9E1

day one reinstatement, 7C2A

managing risk, 9E2

deductible, 7E4

types of, 9E1

defendant, 3 intro

fraudulent claims, 3F1A

direct marketing channels, 2F, 2F1

frequency, 1E2A

features of, 2F1A

significance of, 1E2C

distribution channels, 2F

fulfilment, 3F3A

dual insurance, 1J

fundamental risks, 1C3

duty of disclosure, 5B

at inception, 5B4A

continuing requirement, 5B4C G

modification by policy wordings, 5B4

on alteration, 5B4D general insurance, 1L1, 4B3, 4B4

on renewal, 5B4B glass cover, 1L1A

duty of fair presentation, 5B1 good faith, 5

duty to take reasonable care not to make a governance, 10C1A

misrepresentation, 5 intro Guaranteed Asset Protection (GAP), 1L1B

E H

hazard, 1E3

economic and regulatory capital, 10C1F

health insurance

employers’ liability insurance, 1L1D

critical illness, 1L1G

enforcement, 9A

payment protection indemnity, 1L1G

engineering/breakdown cover, 1L1A

personal accident, 1L1G

equitable premiums, 1G2

sickness, 1L1G

ethical standards, 10A

Heinrich triangle, 1E2B

excepted/excluded perils, 6A2

home service agents, 2F1 Reference copy for CII Face to Face Training

excess, 7E4

homogeneous exposures, 1D4

household goods, 7C2E

F household insurance, 1L1F

facts

that do not need to be disclosed, 5C3 I

farming stock, 7C2F

fidelity guarantee, 1L1B indemnity

Financial Action Task Force (FATF), 9D1, 9D2 application of, 7B

recommendations, 9D2, 9D2A definition of, 7A

terrorist financing, 9D2B limiting factors, 7E

financial crime, 9D measuring, 7C

financial risks, 1C1 modifying, 7D

financial value, 4A1C independent liability method, 8B1B

fire, special perils and ‘all risks’ policies, 1L1A indirect marketing channels, 2F, 2F2

first loss policies, 7D2 inner limits, 7E2

fit and proper requirements, 10B Institute of Insurance and Risk Management

criminal indicators, 10B3A (IIRM), 2I6

financial indicators, 10B3B insurable interest, 1D2

general requirements, 10B2 application, 4D

integrity, 10B3 creation, 4C

knowledge and experience of key functionaries, definition, 4A

10B5 features, 4A1

other indicators, 10B3D of insurers, 4A1D

risk of unsuitability, 10B1 reform of, 4B4

soundness of judgment, 10B4 timing, 4B

supervisory indicators, 10B3C insurable risks, 1D, 1D5

fortuitous event, 1D1 insurance

benefits of, 1H