Page 140 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 140

6/8 M97/February 2018 Reinsurance

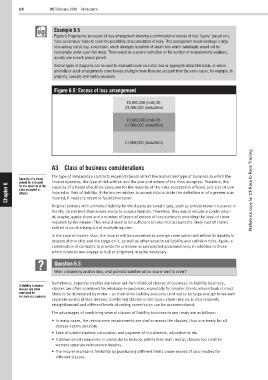

Example 6.5

Figure 6.5 represents an excess of loss arrangement showing a combination of excess of loss ‘layers’ placed on a

‘loss occurrence’ basis to cover the possibility of accumulation of risks. This arrangement would envisage a large

loss arising out of, say, a hurricane, which damages hundreds of small risks which individually would not be

recoverable under a per risk treaty. There would be a severe restriction on the number of reinstatements available,

usually one in each annual period.

Similar types of diagrams can be used to represent cover on a stop loss or aggregate deductible basis, or where

umbrella or clash arrangements cover losses arising in more than one account from the same cause, for example, in

property, casualty and marine accounts.

Figure 6.5: Excess of loss arrangement

£3,000,000 (limit) XS

£3,000,000 (deductible)

£2,000,000 (limit) XS

£1,000,000 (deductible)

£1,000,000 (deductible)

A3 Class of business considerations

The type of reinsurance contracts required should reflect the market and type of business in which the

Capacity of a treaty

should be adequate insurer operates, the type of risk written and the size and nature of the risks accepted. Therefore, the

6 for the majority of the capacity of a treaty should be adequate for the majority of the risks accepted or offered, and size of sum

Chapter offered insured or limit of liability. If the insurer wishes to accept risks outside the definition or of a greater sum Reference copy for CII Face to Face Training

risks accepted or

insured, it needs to resort to facultative cover.

Original policies with unlimited liability for third-party personal injury, such as private motor insurance in

the UK, do not lend themselves easily to surplus treaties. Therefore, they would require a combination

of, maybe, quota share and a number of layers of excess of loss contracts providing the level of cover

required by the insurer. This would need to be sufficient to take into account the likely cost of claims

settled in court arising out of multiple injuries.

In the case of marine risks, the insurer will be concerned to arrange cover which will reflect its liability in

respect of one ship and the cargo on it, as well as other associated liability and collision risks. Again, a

combination of contracts to provide for unknown or unexpected accumulations, in addition to those

which relate to one voyage or hull or shipment, may be necessary.

Question 6.3

When considering aviation risks, what potential liabilities will an insurer want to cover?

Sometimes, separate treaties are taken out for individual classes of business. In liability business,

In liability business,

classes are often classes are often combined for reinsurance purposes, especially for smaller clients whose book is most

combined for likely to be dominated by motor – as their other liability accounts tend not to be large enough to warrant

reinsurance purposes

separate excess of loss treaties. Combining classes under quota share treaties is also relatively

straightforward and different levels of ceding commission can be accommodated.

The advantages of combining several classes of liability business in one treaty are as follows:

• In many cases, the reinsurance requirements are similar across the classes, thus one treaty for all

classes seems sensible.

• Ease of administration: calculation and payment of instalments, adjustments etc.

• It allows small companies in particular to include, within their main treaty, classes too small to

warrant separate reinsurance treaties.

• The insurer maintains flexibility by purchasing different limits under excess of loss treaties for

different classes.