Page 143 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 143

Chapter 6 Reinsurance programmes 6/11

Non-proportional facultative reinsurance for the common account

Had the facultative reinsurance cover in excess of the surplus treaty capacity been purchased on an excess of loss

basis for the common account of the insurer and reinsurers, the outcome of this claim to the reinsurers involved

would have been quite different:

Original sum insured £8m

Retention £400,000 5%

Surplus treaty £4.8m 60%

Total treaty liability £5.2m

Facultative reinsurance for the amount in excess of the treaty capacity for this risk would need to be:

£2.8m XS £5.2m

The loss amount of £4m is below the deductible of the facultative reinsurance and no recovery can be made from

this cover. The loss would be allocated to the insurer and treaty reinsurers in the same proportions as the original

treaty capacity, i.e. 1/13th to the insurer and 12/13ths to treaty reinsurers.

This would leave the insurer with a gross retained loss of £307,692 of which £207,692 would be recoverable from

the treaty per risk excess of loss cover leaving it, again, with a net liability of £100,000 while surplus treaty

reinsurers would pay £3,692,308.

Brokers have developed a number of programmes that assess the impact of the losses arising from the different

underwriting areas of a company in order to formulate a structured programme to reflect its overall needs when

purchasing reinsurance.

Non-proportional facultative reinsurance for the reinsured’s retention

These are theoretical possibilities and explain how loss allocation actually works. It is unlikely that the programme

would be placed in this format; if it were it would require substantial agreement from all participating reinsurers.

The usual method of facultative arrangement for this example is with a retention of £400,000 and a cession of

£4.8m to surplus. The remaining exposure of £2.8m comes back to the cedant, giving them a net exposure of

£3.2m. This exposure could be protected by a facultative excess of loss reinsurance for £2.7m excess of £500,000, Chapter

with the cedant’s first retention still being protected by their risk excess of loss treaty of £400,000 excess of Reference copy for CII Face to Face Training

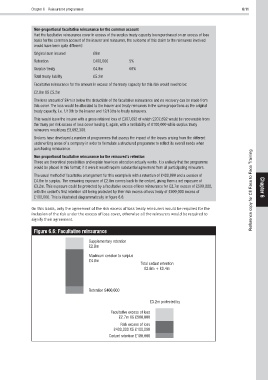

£100,000. This is illustrated diagrammatically in figure 6.6. 6

On this basis, only the agreement of the risk excess of loss treaty reinsurers would be required for the

inclusion of the risk under the excess of loss cover, otherwise all the reinsurers would be required to

signify their agreement.

Figure 6.6: Facultative reinsurance

Supplementary retention

£2.8m

Maximum cession to surplus

£4.8m

Total cedant retention

£2.8m + £0.4m

Retention £400,000

£3.2m protected by

Facultative excess of loss

£2.7m XS £500,000

Risk excess of loss

£400,000 XS £100,000

Cedant retention £100,000