Page 145 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 145

Chapter 6 Reinsurance programmes 6/13

As regards proportional treaties, the only pricing decision is the overriding commission as the price of

proportional reinsurance is the reinsurer’s percentage of the original premium, less any reinsurance

commission, profit commission and overriding commission.

From the reinsurer’s point of view, that commission should, however, take account of, amongst other

things, uncertain premium and claims volumes and associated administration costs, the extent of any

natural perils exposures and any event limitation and loss participation clauses.

B1B Exposure rating

Exposure rating is the practice of using reinsurance exposures together with general industry data about

loss ratios and severity patterns as a basis for estimating your expected losses to the layer and hence

required premium rate. This method has no application to proportional reinsurance and does not rely on

the availability of historical loss data.

Typically, the exposures will be quantified in the policy limit/attachment (or risk) profile of the portfolio.

The industry data will usually take the form of exposure curves or increased limit factors (ILFs)or

something similar to allocate losses between layers of exposure, together with a loss ratio expectation

for the underlying book as a whole. Exposure curves detail the relationship between the accumulation of

insured values and the accumulation of estimated loss.

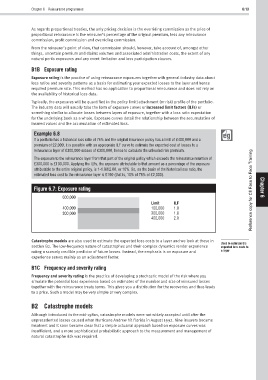

Example 6.8

If a portfolio has a historical loss ratio of 75% and the original insurance policy has a limit of £400,000 and a

premium of £2,000, it is possible with an appropriate ILF curve to estimate the expected cost of losses to a

reinsurance layer of £300,000 excess of £300,000, hence to calculate the unloaded risk premium.

The exposure to the reinsurance layer from that part of the original policy which exceeds the reinsurance retention of

£300,000 is £100,000. Applying the ILFs, the exposure attributable to that amount as a percentage of the exposure

attributable to the entire original policy, is 1-1.80/2.00, or 10%. So, on the basis of the historical loss ratio, the

estimated loss cost to the reinsurance layer is £150 (that is, 10% of 75% of £2,000).

Figure 6.7: Exposure rating Reference copy for CII Face to Face Training Chapter

600,000 6

Limit ILF

400,000 100,000 1.0

300,000 300,000 1.8

400,000 2.0

Catastrophe models are also used to estimate the expected loss costs to a layer and we look at these in

Used to estimate the

section B2. The low-frequency nature of catastrophes and their complex dynamics render experience expected loss costs to

rating a scarcely credible predictor of future losses. Instead, the emphasis is on exposure and a layer

experience serves mainly as an adjustment factor.

B1C Frequency and severity rating

Frequency and severity rating is the practice of developing a stochastic model of the risk where you

simulate the potential loss experience based on estimates of the number and size of reinsured losses

together with the reinsurance treaty terms. This gives you a distribution for the recoveries and thus leads

to a price. Such a model may be very simple or very complex.

B2 Catastrophe models

Although introduced in the mid-1980s, catastrophe models were not widely accepted until after the

unprecedented losses caused when Hurricane Andrew hit Florida in August 1992. Nine insurers became

insolvent and it soon became clear that a simple actuarial approach based on exposure curves was

insufficient, and a more sophisticated probabilistic approach to the measurement and management of

natural catastrophe risk was required.