Page 305 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 305

Chapter 11 Casualty reinsurance 11/15

In the USA, a large proportion of the population is insured by private medical insurance and so the

premiums tend to be actuarially calculated taking claims trends and medical costs into account. The

policy period is usually limited either to expenses incurred and paid during the twelve-month period, or

to those first incurred in the policy period and paid within twelve or 24 months. The cover does not

include occupational accident or illness, which are insured by the workers’ compensation insurance.

Reinsurers require information on the actuarial reports, the claims handling and control methods, and

the policy forms used.

Workers’ compensation ‘carve-out’ referred to in example 11.6, is cover for medical expenses incurred

Laws often require

during the course of employment. Some states of the USA allow certain categories of employers to opt payment of lifetime

out of the otherwise compulsory workers’ compensation insurance and self-fund the medical costs with medical and disability

benefits

the support of insurance. The workers’ compensation laws often require the payment of lifetime medical

and disability benefits. In order for this business to be written as a short-tail personal accident class, the

insurance policy contains a commutation and/or capitalisation clause, usually at five years, which

provides for all outstanding claims to be quantified and with a release of the insurer’s liability following

settlement with the insured.

Consider this…

A commutation clause is a provision that allows for payment of cash by one party to release the other from all future

obligations to pay claims after a certain period of time. It is common in situations where the insurer wishes to settle

and discharge all future obligations for claims that would otherwise have a very long payment pattern.

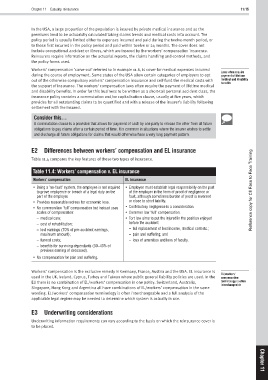

E2 Differences between workers’ compensation and EL insurance

Table 11.4 compares the key features of these two types of insurance.

Table 11.4: Workers’ compensation v. EL insurance

Workers’ compensation EL insurance

• Being a ‘no-fault’ system, the employee is not required • Employee must establish legal responsibility on the part

to prove negligence or breach of a legal duty on the of the employer in the form of proof of negligence or Reference copy for CII Face to Face Training

part of the employer. fault, although sometimes burden of proof is reversed

• Provides reasonable redress for economic loss. or close to strict liability.

• No common law ‘full’ compensation but instead uses • Contributory negligence is a consideration.

scales of compensation: • Common law ‘full’ compensation.

– medical care; • Tort law aims to put the injured in the position enjoyed

– cost of rehabilitation; before the accident:

– lost earnings (70% of pre-accident earnings, – full replacement of lost income, medical cost etc.;

maximum amount); – pain and suffering; and

– funeral costs; – loss of amenities and loss of faculty.

– benefits for surviving dependants (30–40% of

previous earning of deceased).

• No compensation for pain and suffering.

Workers’ compensation is the exclusive remedy in Germany, France, Austria and the USA. EL insurance is

EL/workers’

used in the UK, Ireland, Cyprus, Turkey and Taiwan where public general liability policies are used. In the compensation

EU there is no combination of EL/workers’ compensation in one policy. Switzerland, Australia, terminology is often

interchangeable

Singapore, Hong Kong and Argentina all have combinations of EL/workers’ compensation in the same

wording. EL/workers’ compensation terminology is often interchangeable and a full analysis of the

applicable legal regime may be needed to determine which system is actually in use.

E3 Underwriting considerations

Underwriting information requirements can vary according to the basis on which the reinsurance cover is

to be placed. Chapter

11