Page 308 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 308

11/18 M97/February 2018 Reinsurance

F1 Extent of cover and exclusions

Liability insurance is intended to protect the policyholder from the financial consequences of claims for

Protects from

financial compensation filed under civil law by third parties that have suffered loss or damage.

consequences of

claims for The insurer’s function is both to protect the interests of the policyholder when a claim is intimated by a

compensation

third party and to compensate the policyholder when it is proven that a legal duty exists and that duty

has been breached.

A public liability account can consist of the following subtypes:

Personal liability The liability insurance of a person in their capacity as a private individual, such as a

pedestrian or a cyclist.

Public liability This insurance is concerned with the liability risk resulting from the operations of a

business, including environmental risks. It covers material damage and bodily injury, as

well as consequential financial losses.

Be aware

Insurers seek to control their exposure by placing restrictions on cover provided involving very large values, such as

aircraft, and property which is, or should be, the subject of more specific forms of insurance, such as motor

vehicles.

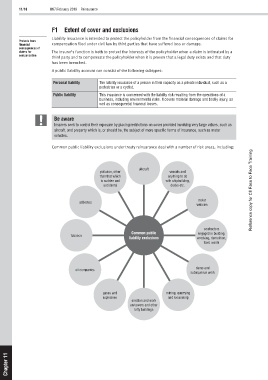

Common public liability exclusions under treaty reinsurance deal with a number of risk areas, including:

aircraft

pollution, other vessels and

than that which anything to do

is sudden and with shipbuilding,

accidental docks etc. Reference copy for CII Face to Face Training

motor

asbestos

vehicles

contractors

Common public engaged in building,

tobacco

liability exclusions wrecking, demolition,

toxic waste

dams and

oil companies

subaqueous work

gases and mining, quarrying

explosives and excavating

erection and work

on towers and other

lofty buildings

11

Chapter