Page 309 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 309

Chapter 11 Casualty reinsurance 11/19

F2 Underwriting considerations

Most of the requirements for other lines of liability reinsurance will also apply to a public liability

Most of the

account. Additional information that should be available to assist the negotiation of reinsurance requirements will also

protection for this type of account would be: apply to a public

liability account

• A detailed description of the reinsured’s portfolio of original risks which would show the extent to

which the book of business consists of relatively simple risks, commercial and heavy industrial risks.

• Details of the original policy limits issued by the reinsured and a profile of these limits and premiums.

This gives reinsurers an indication of liability that may attach to the excess of loss reinsurance

required, and could look like:

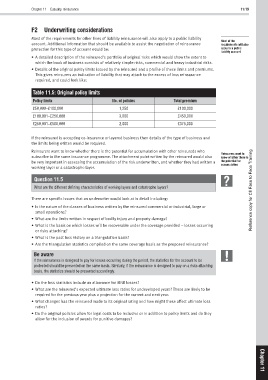

Table 11.5: Original policy limits

Policy limits No. of policies Total premium

£50,000–£100,000 1,250 £100,000

£100,001–£250,000 3,000 £450,000

£250,001–£500,000 2,000 £375,000

If the reinsured is accepting co-insurance or layered business then details of the type of business and

the limits being written would be required.

Reinsurers want to know whether there is the potential for accumulation with other reinsureds who

Reinsurers want to

subscribe to the same insurance programme. The attachment point written by the reinsured would also know whether there is

be very important in assessing the accumulation of the risk underwritten, and whether they had written a the potential for

accumulation

working layer or a catastrophe layer.

Question 11.5

What are the different defining characteristics of working layers and catastrophe layers? Reference copy for CII Face to Face Training

There are specific issues that an underwriter would look at in detail including:

• Is the nature of the classes of business written by the reinsured commercial or industrial, large or

small operations?

• What are the limits written in respect of bodily injury and property damage?

• What is the basis on which losses will be recoverable under the coverage provided – losses occurring

or risks attaching?

• What is the past loss history on a triangulation basis?

• Are the triangulation statistics compiled on the same coverage basis as the proposed reinsurance?

Be aware

If the reinsurance is designed to pay for losses occurring during the period, the statistics for the account to be

protected should be presented on the same basis. Similarly, if the reinsurance is designed to pay on a risks attaching

basis, the statistics should be presented accordingly.

• Do the loss statistics include an allowance for IBNR losses?

• What are the reinsured’s expected ultimate loss ratios for undeveloped years? These are likely to be

required for the previous year plus a projection for the current and next year.

• What changes has the reinsured made to its original rating and how might these affect ultimate loss

ratios?

• Do the original policies allow for legal costs to be inclusive or in addition to policy limits and do they

allow for the inclusion of awards for punitive damages? Chapter

11