Page 313 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 313

Chapter 11 Casualty reinsurance 11/23

G3 Types of reinsurance purchased

Product liability cover is usually integrated into a comprehensive general liability cover and placed along

Usually integrated

the lines outlined for public liability, perhaps with a special provision relating specifically to products into a comprehensive

liability with a sublimit. Otherwise it could be placed facultatively, especially if the underlying company general liability cover

concerned was large or the goods were contentious. Standalone treaty insurance is unusual but, where

found, would be placed most often on an excess of loss basis.

H Professional indemnity

Some special forms of cover that may be offered in connection with insurance for business enterprises

are directors’ and officers’ (D&O) liability and employment practices liability (EPL) insurance.

Professional liability insurance covers material damage, personal injury and pure financial losses for

particular professional groups or institutions such as architects and engineers, physicians and

hospitals, lawyers, solicitors and chartered accountants.

H1 Extent of cover and exclusions

Cover relates to the insured’s legal liability for financial losses caused to third parties, including

Cover relates to the

customers, as a result of errors and/or omissions in the course of the insured’s profession. Financial insured’s legal

loss in this context is the ‘pure financial loss’ which is not consequent upon a bodily injury or property liability for financial

losses caused to third

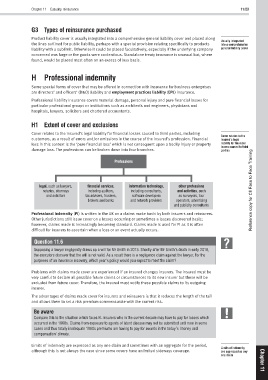

damage loss. The professions can be broken down into four branches. parties

Professions

legal, such as lawyers, financial services, information technology, other professions

notaries, attorneys including auditors, including consultants, and activities, such Reference copy for CII Face to Face Training

and solicitors tax advisers, trustees, software developers as surveyors, tour

brokers and banks and network providers operators, advertising

and publicity consultants

Professional indemnity (PI) is written in the UK on a claims made basis by both insurers and reinsurers.

Other jurisdictions still issue cover on a losses occurring or sometimes a losses discovered basis;

however, claims made is increasingly becoming standard. Claims made is used for PI as it is often

difficult for insurers to ascertain when a loss or an event actually occurs.

Question 11.6

Supposing a lawyer negligently draws up a will for Mr Smith in 2013. Shortly after Mr Smith’s death in early 2018,

the executors discover that the will is not valid. As a result there is a negligence claim against the lawyer. For the

purposes of an insurance recovery, which year’s policy would you expect to meet the claim?

Problems with claims made cover are experienced if an insured changes insurers. The insured must be

very careful to declare all possible future claims or circumstances to its new insurer but these will be

excluded from future cover. Therefore, the insured must notify these possible claims to its outgoing

insurer.

The advantages of claims made cover for insurers and reinsurers is that it reduces the length of the tail

and allows them to set a risk premium commensurate with the current risk.

Be aware

Compare this to the situation which faces EL insurers who in the current decade may have to pay for losses which

occurred in the 1960s. Claims from exposure to agents of latent disease may not be submitted until now in some

cases and thus totally inadequate 1960s premiums are having to pay for awards in the today’s ‘money and

compensation’ climate.

Limits of indemnity are expressed as any one claim and sometimes with an aggregate for the period,

Limits of indemnity

although this is not always the case since some covers have unlimited sideways coverage. are expressed as any

one claim Chapter

11