Page 4 - Watkins Associated Industries, Inc - 2022 Benefits Guide

P. 4

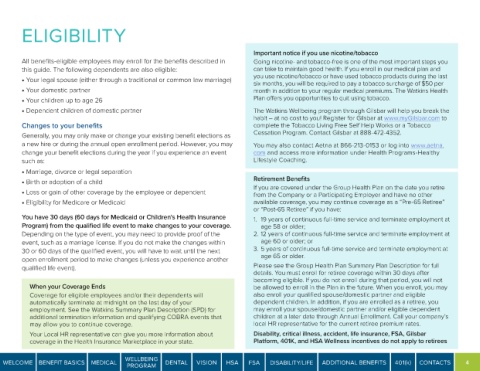

ELIGIBILITY

Important notice if you use nicotine/tobacco

All benefits-eligible employees may enroll for the benefits described in Going nicotine- and tobacco-free is one of the most important steps you

this guide. The following dependents are also eligible: can take to maintain good health. If you enroll in our medical plan and

you use nicotine/tobacco or have used tobacco products during the last

• Your legal spouse (either through a traditional or common law marriage)

six months, you will be required to pay a tobacco surcharge of $50 per

• Your domestic partner month in addition to your regular medical premiums. The Watkins Health

• Your children up to age 26 Plan offers you opportunities to quit using tobacco.

• Dependent children of domestic partner The Watkins Wellbeing program through Gilsbar will help you break the

habit – at no cost to you! Register for Gilsbar at www.myGilsbar.com to

Changes to your benefits complete the Tobacco Living Free Self Help Works or a Tobacco

Generally, you may only make or change your existing benefit elections as Cessation Program. Contact Gilsbar at 888-472-4352.

a new hire or during the annual open enrollment period. However, you may You may also contact Aetna at 866-213-0153 or log into www.aetna.

change your benefit elections during the year if you experience an event com and access more information under Health Programs-Healthy

such as: Lifestyle Coaching.

• Marriage, divorce or legal separation

• Birth or adoption of a child Retirement Benefits

If you are covered under the Group Health Plan on the date you retire

• Loss or gain of other coverage by the employee or dependent from the Company or a Participating Employer and have no other

• Eligibility for Medicare or Medicaid available coverage, you may continue coverage as a “Pre-65 Retiree”

or “Post-65 Retiree” if you have:

You have 30 days (60 days for Medicaid or Children's Health Insurance 1. 19 years of continuous full-time service and terminate employment at

Program) from the qualified life event to make changes to your coverage. age 58 or older;

Depending on the type of event, you may need to provide proof of the 2. 12 years of continuous full-time service and terminate employment at

event, such as a marriage license. If you do not make the changes within age 60 or older; or

30 or 60 days of the qualified event, you will have to wait until the next 3. 5 years of continuous full-time service and terminate employment at

open enrollment period to make changes (unless you experience another age 65 or older.

qualified life event). Please see the Group Health Plan Summary Plan Description for full

details. You must enroll for retiree coverage within 30 days after

becoming eligible. If you do not enroll during that period, you will not

When your Coverage Ends be allowed to enroll in the Plan in the future. When you enroll, you may

Coverage for eligible employees and/or their dependents will also enroll your qualified spouse/domestic partner and eligible

automatically terminate at midnight on the last day of your dependent children. In addition, if you are enrolled as a retiree, you

employment. See the Watkins Summary Plan Description (SPD) for may enroll your spouse/domestic partner and/or eligible dependent

additional termination information and qualifying COBRA events that children at a later date through Annual Enrollment. Call your company’s

may allow you to continue coverage. local HR representative for the current retiree premium rates.

Your Local HR representative can give you more information about Disability, critical illness, accident, life insurance, FSA, Gilsbar

coverage in the Health Insurance Marketplace in your state. Platform, 401K, and HSA Wellness incentives do not apply to retirees

WELLBEING

WELCOME BENEFIT BASICS MEDICAL DENTAL VISION HSA FSA DISABILITY/LIFE ADDITIONAL BENEFITS 401(k) CONTACTS 4

PROGRAM