Page 10 - 2022 AEO Benefit Guide

P. 10

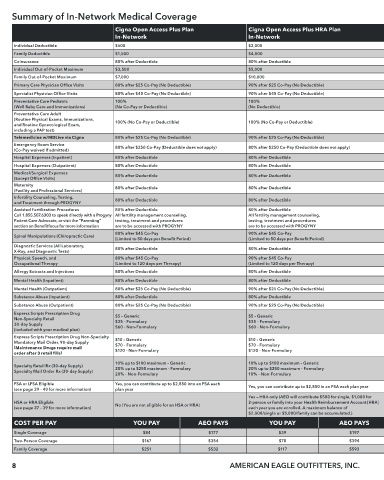

Summary of In-Network Medical Coverage

Cigna Open Access Plus Plan Cigna Open Access Plus HRA Plan Cigna Health Savings Account Plan Cigna Economy Health Savings Account Plan

In-Network In-Network In-Network In-Network

Individual Deductible $500 $2,000 Individual Deductible $1,400 $3,000

Family Deductible $1,500 $4,000 Family Deductible $2,800 $6,000

Coinsurance 80% after Deductible 80% after Deductible Coinsurance 80% after Deductible 80% after Deductible

Individual Out-of-Pocket Maximum $3,500 $5,000 Individual Out-of-Pocket Maximum $4,300 $6,550

Family Out-of-Pocket Maximum $7,000 $10,000 Family Out-of-Pocket Maximum $6,550 $13,100

Primary Care Physician Office Visits 80% after $25 Co-Pay (No Deductible) 90% after $25 Co-Pay (No Deductible) Primary Care Physician Office Visits 80% after Deductible 80% after Deductible

Specialist Physician Office Visits 80% after $45 Co-Pay (No Deductible) 90% after $45 Co-Pay (No Deductible) Specialist Physician Office Visits 80% after Deductible 80% after Deductible

Preventative Care Pediatric 100% 100% Preventative Care Pediatric 100% 100%

(Well Baby Care and Immunizations) (No Co-Pay or Deductible) (No Deductible) (Well Baby Care and Immunizations) (No Deductible) (No Deductible)

Preventative Care Adult Preventative Care Adult

(Routine Physical Exams, Immunizations, 100% (No Co-Pay or Deductible) 100% (No Co-Pay or Deductible) (Routine Physical Exams, Immunizations, 100% (No Deductible) 100% (No Deductible)

and Routine Gynecological Exam, and Routine Gynecological Exam,

including a PAP test) including a PAP test)

Telemedicine w/MDLive via Cigna 80% after $25 Co-Pay (No Deductible) 90% after $25 Co-Pay (No Deductible) Telemedicine w/MDLive via Cigna 80% after Deductible 80% after Deductible

Emergency Room Service 80% after $250 Co-Pay (Deductible does not apply) 80% after $250 Co-Pay (Deductible does not apply) Emergency Room Service 80% after Deductible 80% after Deductible

(Co-Pay waived if admitted) (Co-Pay waived if admitted)

Hospital Expenses (Inpatient) 80% after Deductible 80% after Deductible Hospital Expenses (Inpatient) 80% after Deductible 80% after Deductible

Hospital Expenses (Outpatient) 80% after Deductible 80% after Deductible Hospital Expenses (Outpatient) 80% after Deductible 80% after Deductible

Medical/Surgical Expenses 80% after Deductible 80% after Deductible Medical/Surgical Expenses 80% after Deductible 80% after Deductible

(Except Office Visits) (Except Office Visits)

Maternity 80% after Deductible 80% after Deductible Maternity 80% after Deductible 80% after Deductible

(Facility and Professional Services) (Facility and Professional Services)

Infertility Counseling, Testing, 80% after Deductible 80% after Deductible Infertility Counseling, Testing, 80% after Deductible 80% after Deductible

and Treatment through PROGYNY and Treatment through PROGYNY

Assisted Fertilization Procedures 80% after Deductible 80% after Deductible Assisted Fertilization Procedures 80% after Deductible 80% after Deductible

Call 1.855.507.6303 to speak directly with a Progyny All fertility management counseling, All fertility management counseling, Call 1.855.507.6303 to speak directly with a Progyny All fertility management counseling, All fertility management counseling,

Patient Care Advocate, or visit the “Parenting” testing, treatment and procedures testing, treatment and procedures Patient Care Advocate, or visit the “Parenting” testing, treatment and procedures testing, treatment and procedures

section on Benefitfocus for more information are to be accessed with PROGYNY are to be accessed with PROGYNY section on Benefitfocus for more information are to be accessed with PROGYNY are to be accessed with PROGYNY

80% after $45 Co-Pay 90% after $45 Co-Pay 80% after Deductible 80% after Deductible

Spinal Manipulations (Chiropractic Care) Spinal Manipulations (Chiropractic Care)

(Limited to 50 days per Benefit Period) (Limited to 50 days per Benefit Period) (Limited to 50 days per Benefit Period) (Limited to 50 days per Benefit Period)

Diagnostic Services (All Laboratory, 80% after Deductible 80% after Deductible Diagnostic Services (All Laboratory, 80% after Deductible 80% after Deductible

X-Ray, and Diagnostic Tests) X-Ray, and Diagnostic Tests)

Physical, Speech, and 80% after $45 Co-Pay 90% after $45 Co-Pay Physical, Speech, and 80% after Deductible 80% after Deductible

Occupational Therapy (Limited to 120 days per Therapy) (Limited to 120 days per Therapy) Occupational Therapy (Limited to 120 days per Therapy) (Limited to 120 days per Therapy)

Allergy Extracts and Injections 80% after Deductible 80% after Deductible Allergy Extracts and Injections 80% after Deductible 80% after Deductible

Mental Health (Inpatient) 80% after Deductible 80% after Deductible Mental Health (Inpatient) 80% after Deductible 80% after Deductible

Mental Health (Outpatient) 80% after $25 Co-Pay (No Deductible) 90% after $25 Co-Pay (No Deductible) Mental Health (Outpatient) 80% after Deductible 80% after Deductible

Substance Abuse (Inpatient) 80% after Deductible 80% after Deductible Substance Abuse (Inpatient) 80% after Deductible 80% after Deductible

Substance Abuse (Outpatient) 80% after $25 Co-Pay (No Deductible) 90% after $25 Co-Pay (No Deductible) Substance Abuse (Outpatient) 80% after Deductible 80% after Deductible

Express Scripts Prescription Drug $5 – Generic $5 – Generic Express Scripts Prescription Drug Co-Pay structure AFTER deductible has been met Co-Pay structure AFTER deductible has been met

Non-Specialty Retail $35 – Formulary $35 – Formulary Non-Specialty Retail $5 – Generic $5 – Generic

30-day Supply 30-day Supply $35 – Formulary $35 – Formulary

(included with your medical plan) $60 – Non-Formulary $60 – Non-Formulary (included with your medical plan) $60 – Non-Formulary $60 – Non-Formulary

Express Scripts Prescription Drug Non-Specialty $10 – Generic $10 – Generic Express Scripts Prescription Drug Co-Pay structure AFTER deductible has been met Co-Pay structure AFTER deductible has been met

Mandatory Mail Order, 90-day Supply Non-Specialty Mandatory Mail Order, $10 – Generic $10 – Generic

( Maintenance Drugs require mail $70 – Formulary $70 – Formulary 90-day Supply ( Maintenance Drugs $70 – Formulary $70 – Formulary

order after 3 retail fills ) $120 – Non-Formulary $120 – Non-Formulary require mail order after 3 retail fills ) $120 – Non-Formulary $120 – Non-Formulary

AFTER deductible has been met AFTER deductible has been met

10% up to $100 maximum – Generic 10% up to $100 maximum – Generic

Specialty Retail Rx (30-day Supply) 20% up to $250 maximum – Formulary 20% up to $250 maximum – Formulary Specialty Retail Rx (30-day Supply) 10% up to $100 maximum – Generic 10% up to $100 maximum – Generic

Specialty Mail Order Rx (30-day Supply) Specialty Mail Order Rx (30-day Supply) 20% up to $250 maximum – Formulary 20% up to $250 maximum – Formulary

20% – Non-Formulary 10% – Non-Formulary

20% – Non-Formulary 20% – Non-Formulary

FSA or LFSA Eligible Yes, you can contribute up to $2,850 into an FSA each Yes, you can contribute up to $2,850 in an FSA each plan year FSA or LFSA Eligible Yes, you can contribute up to $2,850 in an LFSA each plan year Yes, you can contribute up to $2,850 in an LFSA each plan year

(see page 39 – 40 for more information) plan year (see page 39 – 40 for more information)

Yes — HRA only (AEO will contribute $500 for single, $1,000 for Yes — HSA only (You can contribute up to $3,650 for single or Yes — HSA only (You can contribute up to $3,650 for single or

HSA or HRA Eligible No (You are not eligible for an HSA or HRA) 2-person or family into your Health Reimbursement Account [HRA] HSA or HRA Eligible up to $7,300 for 2-person or family; AEO will contribute $500 up to $7,300 for 2-person or family; AEO will contribute $250

(see page 37 – 39 for more information) each year you are enrolled. A maximum balance of (see page 37 – 39 for more information) for single, $1,000 for 2-person or family to your HSA) for single, $500 for 2-person or family to your HSA)

$2,500/single or $5,000/family can be accumulated.)

COST PER PAY YOU PAY AEO PAYS YOU PAY AEO PAYS COST PER PAY YOU PAY AEO PAYS YOU PAY AEO PAYS

Single Coverage $84 $177 $39 $197 Single Coverage $50 $199 $25 $183

Two-Person Coverage $167 $354 $78 $394 Two-Person Coverage $100 $398 $51 $364

Family Coverage $251 $532 $117 $593 Family Coverage $150 $598 $76 $548

8 8 AMERICAN EAGLE OUTFITTERS, INC.