Page 19 - Watermark 2022 Benefits Guide - CA

P. 19

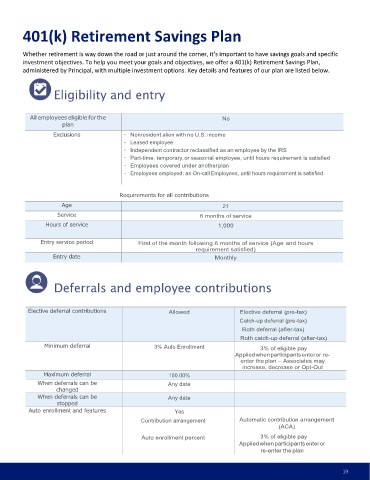

401(k) Retirement Savings Plan

Whether retirement is way down the road or just around the corner, it’s important to have savings goals and specific

investment objectives. To help you meet your goals and objectives, we offer a 401(k) Retirement Savings Plan,

administered by Principal, with multiple investment options. Key details and features of our plan are listed below.

Eligibility and entry

All employees eligible for the

No

plan

Exclusions · Nonresident alien with no U.S. income

· Leased employee

· Independent contractor reclassified as an employee by the IRS

· Part-time, temporary, or seasonal employee, until hours requirement is satisfied

· Employees covered under another plan

· Employees employed: as On-call Employees, until hours requirement is satisfied

Requirements for all contributions

Age 21

Service 6 months of service

Hours of service 1,000

Entry service period First of the month following 6 months of service (Age and hours

requirement satisfied)

Entry date Monthly

Deferrals and employee contributions

Elective deferral contributions Allowed Elective deferral (pre-tax)

Catch-up deferral (pre-tax)

Roth deferral (after-tax)

Roth catch-up deferral (after-tax)

Minimum deferral 3% Auto Enrollment 3% of eligible pay

Applied when participants enter or re-

enter the plan – Associates may

increase, decrease or Opt-Out

Maximum deferral 100.00%

When deferrals can be Any date

changed

When deferrals can be Any date

stopped

Auto enrollment and features Yes

Contribution arrangement Automatic contribution arrangement

(ACA)

Auto enrollment percent 3% of eligible pay

Applied when participants enter or

re-enter the plan

19