Page 6 - Watermark 2022 Benefits Guide - CA

P. 6

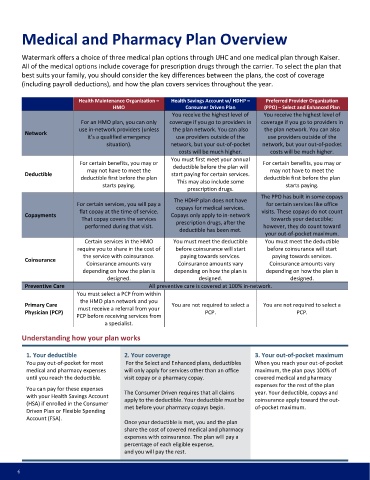

Medical and Pharmacy Plan Overview

Watermark offers a choice of three medical plan options through UHC and one medical plan through Kaiser.

All of the medical options include coverage for prescription drugs through the carrier. To select the plan that

best suits your family, you should consider the key differences between the plans, the cost of coverage

(including payroll deductions), and how the plan covers services throughout the year.

Health Maintenance Organization – Health Savings Account w/ HDHP – Preferred Provider Organization

HMO Consumer Driven Plan (PPO) – Select and Enhanced Plan

You receive the highest level of You receive the highest level of

For an HMO plan, you can only coverage if you go to providers in coverage if you go to providers in

use in-network providers (unless the plan network. You can also the plan network. You can also

Network

it’s a qualified emergency use providers outside of the use providers outside of the

situation). network, but your out-of-pocket network, but your out-of-pocket

costs will be much higher. costs will be much higher.

You must first meet your annual

For certain benefits, you may or For certain benefits, you may or

deductible before the plan will

may not have to meet the may not have to meet the

Deductible start paying for certain services.

deductible first before the plan This may also include some deductible first before the plan

starts paying. starts paying.

prescription drugs.

The PPO has built in some copays

The HDHP plan does not have

For certain services, you will pay a for certain services like office

copays for medical services.

flat copay at the time of service. visits. These copays do not count

Copayments Copays only apply to in-network

That copay covers the services towards your deductible;

prescription drugs, after the

performed during that visit. however, they do count toward

deductible has been met.

your out-of-pocket maximum.

Certain services in the HMO You must meet the deductible You must meet the deductible

require you to share in the cost of before coinsurance will start before coinsurance will start

the service with coinsurance. paying towards services. paying towards services.

Coinsurance

Coinsurance amounts vary Coinsurance amounts vary Coinsurance amounts vary

depending on how the plan is depending on how the plan is depending on how the plan is

designed. designed. designed.

Preventive Care All preventive care is covered at 100% in-network.

You must select a PCP from within

the HMO plan network and you

Primary Care You are not required to select a You are not required to select a

must receive a referral from your

Physician (PCP) PCP. PCP.

PCP before receiving services from

a specialist.

Understanding how your plan works

1. Your deductible 2. Your coverage 3. Your out-of-pocket maximum

You pay out-of-pocket for most For the Select and Enhanced plans, deductibles When you reach your out-of-pocket

medical and pharmacy expenses will only apply for services other than an office maximum, the plan pays 100% of

until you reach the deductible. visit copay or a pharmacy copay. covered medical and pharmacy

expenses for the rest of the plan

You can pay for these expenses The Consumer Driven requires that all claims year. Your deductible, copays and

with your Health Savings Account

apply to the deductible. Your deductible must be coinsurance apply toward the out-

(HSA) if enrolled in the Consumer

met before your pharmacy copays begin. of-pocket maximum.

Driven Plan or Flexible Spending

Account (FSA).

Once your deductible is met, you and the plan

share the cost of covered medical and pharmacy

expenses with coinsurance. The plan will pay a

percentage of each eligible expense,

and you will pay the rest.

6