Page 12 - 2022 Insurity OE Guide FINAL

P. 12

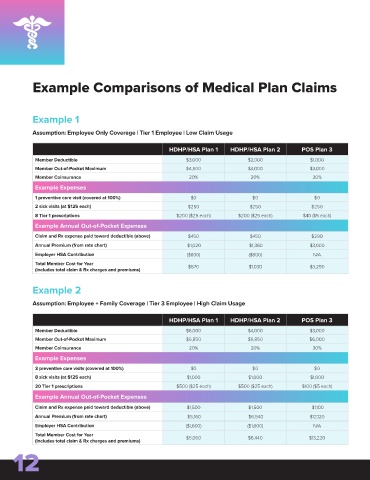

Example Comparisons of Medical Plan Claims

Example 1

Assumption: Employee Only Coverage | Tier 1 Employee | Low Claim Usage

HDHP/HSA Plan 1 HDHP/HSA Plan 2 POS Plan 3

Member Deductible $3,000 $2,000 $1,000

Member Out-of-Pocket Maximum $4,500 $4,000 $3,000

Member Coinsurance 20% 20% 30%

Example Expenses

1 preventive care visit (covered at 100%) $0 $0 $0

2 sick visits (at $125 each) $250 $250 $250

8 Tier 1 prescriptions $200 ($25 each) $200 ($25 each) $40 ($5 each)

Example Annual Out-of-Pocket Expenses

Claim and Rx expense paid toward deductible (above) $450 $450 $290

Annual Premium (from rate chart) $1,020 $1,380 $3,000

Employer HSA Contribution ($800) ($800) N/A

Total Member Cost for Year

(includes total claim & Rx charges and premiums) $670 $1,030 $3,290

Example 2

Assumption: Employee + Family Coverage | Tier 3 Employee | High Claim Usage

HDHP/HSA Plan 1 HDHP/HSA Plan 2 POS Plan 3

Member Deductible $6,000 $4,000 $3,000

Member Out-of-Pocket Maximum $6,850 $6,850 $6,000

Member Coinsurance 20% 20% 30%

Example Expenses

3 preventive care visits (covered at 100%) $0 $0 $0

8 sick visits (at $125 each) $1,000 $1,000 $1,000

20 Tier 1 prescriptions $500 ($25 each) $500 ($25 each) $100 ($5 each)

Example Annual Out-of-Pocket Expenses

Claim and Rx expense paid toward deductible (above) $1,500 $1,500 $1,100

Annual Premium (from rate chart) $5,160 $6,540 $12,120

Employer HSA Contribution ($1,600) ($1,600) N/A

Total Member Cost for Year $5,060 $6,440 $13,220

(includes total claim & Rx charges and premiums)

12