Page 7 - 2022 Insurity OE Guide FINAL

P. 7

UnitedHealthcare – Health Care Plans

Choice Plus Network – Group Number #755681

Insurity offers 3 medical plans: two High Deductible Health Plans (HDHP) with a Health Savings Account (HSA), and a Point of

Service (POS) plan.

Out-of-pocket maximums apply to all of the plans. This is the maximum amount you will pay for your portion of health care

claim costs during the plan year. Once you have reached the out-of-pocket maximum (OOP Max), the plan will cover your

eligible medical expenses at 100% for the rest of the plan year.

Note: When using out-of-network providers, the member will be responsible for billed amounts above usual and customary

rates even if they met their out-of-network/out-of-pocket maximum.

Although there are many similarities between POS and HDHP/HSA plans, there are some key differences which are

summarized below:

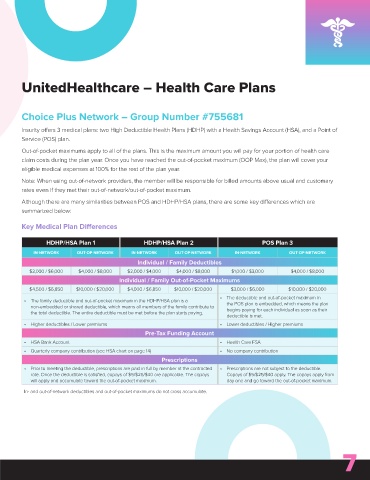

Key Medical Plan Differences

HDHP/HSA Plan 1 HDHP/HSA Plan 2 POS Plan 3

IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK

Individual / Family Deductibles

$3,000 / $6,000 $4,000 / $8,000 $2,000 / $4,000 $4,000 / $8,000 $1,000 / $3,000 $4,000 / $8,000

Individual / Family Out-of-Pocket Maximums

$4,500 / $6,850 $10,000 / $20,000 $4,000 / $6,850 $10,000 / $20,000 $3,000 / $6,000 $10,000 / $20,000

• The deductible and out-of-pocket maximum in

• The family deductible and out-of-pocket maximum in the HDHP/HSA plan is a the POS plan is embedded, which means the plan

non-embedded or shared deductible, which means all members of the family contribute to begins paying for each individual as soon as their

the total deductible. The entire deductible must be met before the plan starts paying.

deductible is met.

• Higher deductibles / Lower premiums • Lower deductibles / Higher premiums

Pre-Tax Funding Account

• HSA Bank Account • Health Care FSA

• Quarterly company contribution (see HSA chart on page 14) • No company contribution

Prescriptions

• Prior to meeting the deductible, prescriptions are paid in full by member at the contracted • Prescriptions are not subject to the deductible.

rate. Once the deductible is satisfied, copays of $5/$25/$40 are applicable. The copays Copays of $5/$25/$40 apply. The copays apply from

will apply and accumulate toward the out-of-pocket maximum. day one and go toward the out-of-pocket maximum.

In- and out-of-network deductibles and out-of-pocket maximums do not cross accumulate.

7