Page 14 - 2022 Insurity OE Guide FINAL

P. 14

Optum Bank – Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-advantaged medical savings account available to employees who are enrolled

in one of the HSA medical plans. An HSA allows you to set aside money on a pre-tax basis to pay for qualified medical

expenses. Money comes out of each paycheck and is deposited into your account for future use. Once you reach age 65

you can also use the money for non-medical expenses (although these amounts will be taxed as ordinary income).

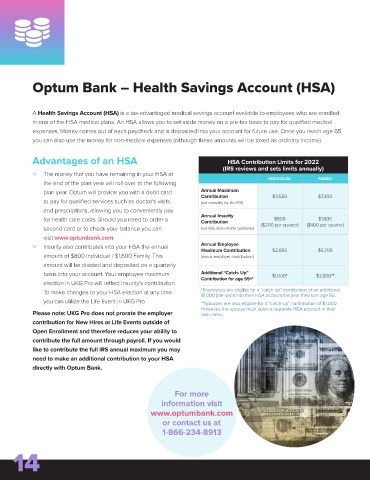

Advantages of an HSA HSA Contribution Limits for 2022

(IRS reviews and sets limits annually)

O The money that you have remaining in your HSA at

INDIVIDUAL FAMILY

the end of the plan year will roll over to the following

plan year. Optum will provide you with a debit card Annual Maximum

Contribution $3,650 $7,300

to pay for qualified services such as doctor’s visits (set annually by the IRS)

and prescriptions, allowing you to conveniently pay

Annual Insurity

for health care costs. Should you need to order a Contribution $800 $1,600

second card or to check your balance you can (contributions made quarterly) ($200 per quarter) ($400 per quarter)

visit www.optumbank.com.

O Insurity also contributes into your HSA the annual Annual Employee

Maximum Contribution $2,850 $5,700

amount of $800 Individual / $1,600 Family. This (minus employer contribution)

amount will be divided and deposited on a quarterly

basis into your account. Your employee maximum Additional “Catch- Up” $1,000* $2,000**

Contribution for age 55+*

election in UKG Pro will reflect Insurity’s contribution.

To make changes to your HSA election at any time *Employees are eligible for a “catch-up” contribution of an additional

$1,000 (per year) into their HSA account the year they turn age 55.

you can utilize the Life Event in UKG Pro. **Spouses are also eligible for a “catch-up” contribution of $1,000.

However, the spouse must open a separate HSA account in their

Please note: UKG Pro does not prorate the employer own name.

contribution for New Hires or Life Events outside of

Open Enrollment and therefore reduces your ability to

contribute the full amount through payroll. If you would

like to contribute the full IRS annual maximum you may

need to make an additional contribution to your HSA

directly with Optum Bank.

For more

information visit

www.optumbank.com

or contact us at

1-866-234-8913

14