Page 28 - 2022 Insurity OE Guide FINAL

P. 28

UnitedHealthcare – Health Care Flexible

Spending Account (HCFSA)

A Health Care Flexible Spending Account (HCFSA) is a pre-tax benefit program that helps you pay for health care costs

that are not covered by your health care plan or elsewhere, using tax-free dollars. An HCFSA can be elected if you enroll

in Insurity’s POS Medical plan, or if you have other non-HDHP coverage outside of Insurity. You cannot enroll in both a

HDHP plan with an HSA account and a Health Care Spending Account. If you are enrolled in Medicare and enroll in one of

Insurity’s HDHPs, you are eligible to contribute to a Health Care FSA.

Your contribution is deducted from your paycheck on a pre-tax basis and is deposited into your account directly. When you

incur expenses during the plan year, you can access the funds in your account(s) to pay for eligible health care expenses.

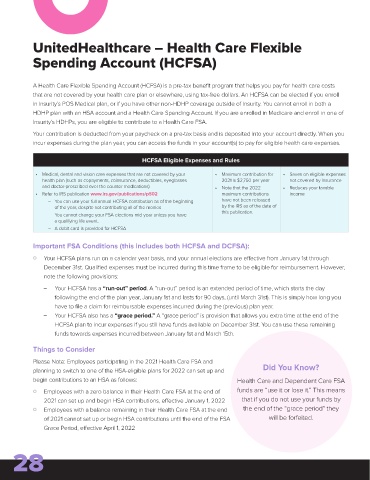

HCFSA Eligible Expenses and Rules

• Medical, dental and vision care expenses that are not covered by your • Maximum contribution for • Saves on eligible expenses

health plan (such as copayments, coinsurance, deductibles, eyeglasses 2021 is $2,750 per year not covered by insurance

and doctor-prescribed over the counter medications) • Note that the 2022 • Reduces your taxable

• Refer to IRS publication www.irs.gov/publications/p502 maximum contributions income

– You can use your full annual HCFSA contribution as of the beginning have not been released

of the year, despite not contributing all of the monies by the IRS as of the date of

this publication.

– You cannot change your FSA elections mid-year unless you have

a qualifying life event.

– A debit card is provided for HCFSA

Important FSA Conditions (this includes both HCFSA and DCFSA):

O Your HCFSA plans run on a calendar year basis, and your annual elections are effective from January 1st through

December 31st. Qualified expenses must be incurred during this time frame to be eligible for reimbursement. However,

note the following provisions:

– Your HCFSA has a “run-out” period. A “run-out” period is an extended period of time, which starts the day

following the end of the plan year, January 1st and lasts for 90 days, (until March 31st). This is simply how long you

have to file a claim for reimbursable expenses incurred during the (previous) plan year.

– Your HCFSA also has a “grace period.” A “grace period” is provision that allows you extra time at the end of the

HCFSA plan to incur expenses if you still have funds available on December 31st. You can use these remaining

funds towards expenses incurred between January 1st and March 15th.

Things to Consider

Please Note: Employees participating in the 2021 Health Care FSA and

planning to switch to one of the HSA-eligible plans for 2022 can set up and Did You Know?

begin contributions to an HSA as follows: Health Care and Dependent Care FSA

O Employees with a zero balance in their Health Care FSA at the end of funds are “use it or lose it.” This means

2021 can set up and begin HSA contributions, effective January 1, 2022 that if you do not use your funds by

O Employees with a balance remaining in their Health Care FSA at the end the end of the “grace period” they

of 2021 cannot set up or begin HSA contributions until the end of the FSA will be forfeited.

Grace Period, effective April 1, 2022

28