Page 37 - 2022 Insurity OE Guide FINAL

P. 37

Reliance Standard – Disability Plans

Insurity offers Short-Term and Long-Term Disability coverage through a partnership with Matrix through Reliance Standard.

These benefits are offered to you at no additional cost.

Short-Term Disability (STD)* – A short-term disability is an illness or an injury that prevents a person from working entirely

or at full capacity for a period of time that is usually six months or less. Short-Term Disability insurance provides financial

protection for lost wages in the event the insured incurs a short-term disability.

Insurity has a self-insured disability plan and benefits are paid through regular Insurity payroll processing based on medical

need and your length of service. Claim adjudication is handled by Matrix.

Long-Term Disability (LTD) – A long-term disability is an injury or illness that causes a person to be unable to work for an

extended period of time (more than 6 months). LTD begins once your STD benefits have been exhausted, and you are still

unable to perform the functions of your job. This coverage continues until you return to work, are no longer disabled, or

reach Social Security retirement age.

* Please note that many States also have State disability plans in place. Each employee disability is handled case by case depending on the rules

and process for their applicable State. These State plans may offset the programs shown below. Please contact InsurityBenefits@insurity.com for

further information.

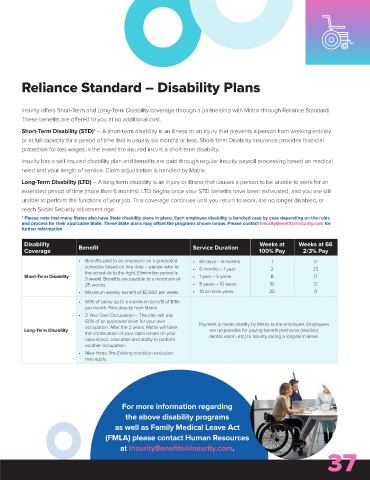

Disability Weeks at Weeks at 66

Coverage Benefit Service Duration 100% Pay 2/3% Pay

• Benefits paid to an employee on a graduated • 60 days – 6 months 1 0

schedule based on hire date – please refer to • 6 months – 1 year 2 23

the schedule to the right. Elimination period is

Short-Term Disability • 1 year – 5 years 8 17

(1 week). Benefits are payable to a maximum of

25 weeks. • 5 years – 10 years 13 12

• Maximum weekly benefit of $2,500 per week. • 10 or more years 25 0

• 60% of salary up to a maximum benefit of $15k

per month. Paid directly from Matrix.

• 2 Year Own Occupation – The plan will pay

60% of an approved claim for your own Payment is made directly by Matrix to the employee. Employees

occupation. After the 2 years, Matrix will base

Long-Term Disability are responsible for paying benefit premiums (medical,

the continuation of your claim based on your dental, vision, etc.) to Insurity during a long-term leave.

experience, education and ability to preform

another occupation.

• New Hires: Pre-Existing condition exclusion

may apply.

For more information regarding

the above disability programs

as well as Family Medical Leave Act

(FMLA) please contact Human Resources

37

at InsurityBenefits@insurity.com.