Page 21 - Mersen Benefit Guide Local 502

P. 21

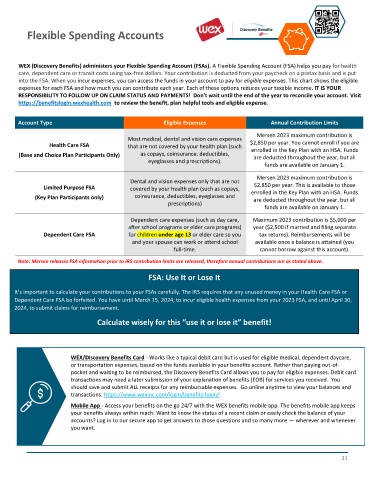

Flexible Spending Accounts

WEX (Discovery Benefits) administers your Flexible Spending Account (FSAs). A Flexible Spending Account (FSA) helps you pay for health

care, dependent care or transit costs using tax-free dollars. Your contribution is deducted from your paycheck on a pretax basis and is put

into the FSA. When you incur expenses, you can access the funds in your account to pay for eligible expenses. This chart shows the eligible

expenses for each FSA and how much you can contribute each year. Each of these options reduces your taxable income. IT IS YOUR

RESPONSIBILITY TO FOLLOW UP ON CLAIM STATUS AND PAYMENTS! Don’t wait until the end of the year to reconcile your account. Visit

https://benefitslogin.wexhealth.com to review the benefit, plan helpful tools and eligible expense.

Account Type Eligible Expenses Annual Contribution Limits

Mersen 2023 maximum contribution is

Most medical, dental and vision care expenses

Health Care FSA that are not covered by your health plan (such $2,850 per year. You cannot enroll if you are

(Base and Choice Plan Participants Only) as copays, coinsurance, deductibles, enrolled in the Key Plan with an HSA. Funds

are deducted throughout the year, but all

eyeglasses and prescriptions).

funds are available on January 1.

Mersen 2023 maximum contribution is

Dental and vision expenses only that are not

Limited Purpose FSA covered by your health plan (such as copays, $2,850 per year. This is available to those

(Key Plan Participants only) coinsurance, deductibles, eyeglasses and enrolled in the Key Plan with an HSA. Funds

are deducted throughout the year, but all

prescriptions)

funds are available on January 1.

Dependent care expenses (such as day care, Maximum 2023 contribution is $5,000 per

after school programs or elder care programs) year ($2,500 if married and filing separate

Dependent Care FSA for children under age 13 or elder care so you tax returns). Reimbursements will be

and your spouse can work or attend school available once a balance is attained (you

full-time. cannot borrow against this account).

Note: Mersen releases FSA information prior to IRS contribution limits are released, therefore annual contributions are as stated above.

FSA: Use It or Lose It

It’s important to calculate your contributions to your FSAs carefully. The IRS requires that any unused money in your Health Care FSA or

Dependent Care FSA be forfeited. You have until March 15, 2024, to incur eligible health expenses from your 2023 FSA, and until April 30,

2024, to submit claims for reimbursement.

Calculate wisely for this “use it or lose it” benefit!

WEX/Discovery Benefits Card - Works like a typical debit card but is used for eligible medical, dependent daycare,

or transportation expenses, based on the funds available in your benefits account. Rather than paying out-of-

pocket and waiting to be reimbursed, the Discovery Benefits Card allows you to pay for eligible expenses. Debit card

transactions may need a later submission of your explanation of benefits (EOB) for services you received. You

should save and submit ALL receipts for any reimbursable expenses. Go online anytime to view your balances and

transactions. https://www.wexinc.com/login/benefits-login/.

Mobile App - Access your benefits on the go 24/7 with the WEX benefits mobile app. The benefits mobile app keeps

your benefits always within reach. Want to know the status of a recent claim or easily check the balance of your

accounts? Log in to our secure app to get answers to those questions and so many more — wherever and whenever

you want.

21