Page 31 - 2022 SoFi Benefits Guide

P. 31

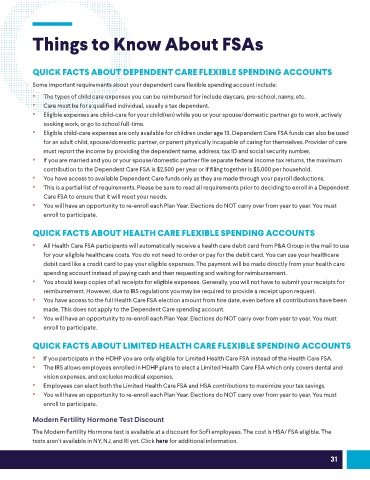

Things to Know About FSAs

QUICK FACTS ABOUT DEPENDENT CARE FLEXIBLE SPENDING ACCOUNTS

Some important requirements about your dependent care flexible spending account include:

The types of child care expenses you can be reimbursed for include daycare, pre-school, nanny, etc.

Care must be for a qualified individual, usually a tax dependent.

Eligible expenses are child-care for your child(ren) while you or your spouse/domestic partner go to work, actively

seeking work, or go to school full-time.

Eligible child-care expenses are only available for children under age 13. Dependent Care FSA funds can also be used

for an adult child, spouse/domestic partner, or parent physically incapable of caring for themselves. Provider of care

must report the income by providing the dependent name, address, tax ID and social security number.

If you are married and you or your spouse/domestic partner file separate federal income tax returns, the maximum

contribution to the Dependent Care FSA is $2,500 per year or if filing together is $5,000 per household.

You have access to available Dependent Care funds only as they are made through your payroll deductions.

This is a partial list of requirements. Please be sure to read all requirements prior to deciding to enroll in a Dependent

Care FSA to ensure that it will meet your needs.

You will have an opportunity to re-enroll each Plan Year. Elections do NOT carry over from year to year. You must

enroll to participate.

QUICK FACTS ABOUT HEALTH CARE FLEXIBLE SPENDING ACCOUNTS

All Health Care FSA participants will automatically receive a health care debit card from P&A Group in the mail to use

for your eligible healthcare costs. You do not need to order or pay for the debit card. You can use your healthcare

debit card like a credit card to pay your eligible expenses. The payment will be made directly from your health care

spending account instead of paying cash and then requesting and waiting for reimbursement.

You should keep copies of all receipts for eligible expenses. Generally, you will not have to submit your receipts for

reimbursement. However, due to IRS regulations you may be required to provide a receipt upon request.

You have access to the full Health Care FSA election amount from hire date, even before all contributions have been

made. This does not apply to the Dependent Care spending account.

You will have an opportunity to re-enroll each Plan Year. Elections do NOT carry over from year to year. You must

enroll to participate.

QUICK FACTS ABOUT LIMITED HEALTH CARE FLEXIBLE SPENDING ACCOUNTS

If you participate in the HDHP you are only eligible for Limited Health Care FSA instead of the Health Care FSA.

The IRS allows employees enrolled in HDHP plans to elect a Limited Health Care FSA which only covers dental and

vision expenses, and excludes medical expenses.

Employees can elect both the Limited Health Care FSA and HSA contributions to maximize your tax savings.

You will have an opportunity to re-enroll each Plan Year. Elections do NOT carry over from year to year. You must

enroll to participate.

Modern Fertility Hormone Test Discount

The Modern Fertility Hormone test is available at a discount for SoFi employees. The cost is HSA/ FSA eligible. The

tests aren’t available in NY, NJ, and RI yet. Click here for additional information.

31