Page 11 - 2022 Penn Engineering Guide

P. 11

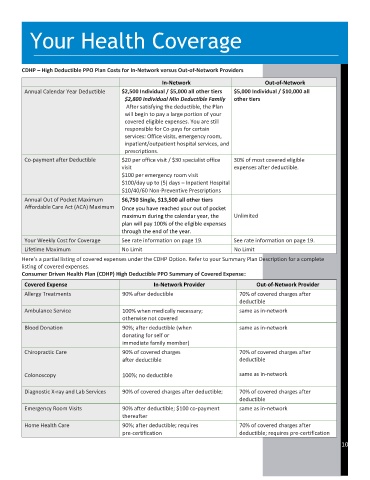

Your Health Coverage

CDHP – High Deductible PPO Plan Costs for In-Network versus Out-of-Network Providers

In-Network Out-of-Network

Annual Calendar Year Deductible $2,500 Individual / $5,000 all other tiers $5,000 Individual / $10,000 all

$2,800 Individual Min Deductible Family other tiers

After satisfying the deductible, the Plan

will begin to pay a large portion of your

covered eligible expenses. You are still

responsible for Co-pays for certain

services: Office visits, emergency room,

inpatient/outpatient hospital services, and

prescriptions.

Co-payment after Deductible $20 per office visit / $30 specialist office 30% of most covered eligible

visit expenses after deductible.

$100 per emergency room visit

$100/day up to (5) days – Inpatient Hospital

$10/40/60 Non-Preventive Prescriptions

Annual Out of Pocket Maximum $6,750 Single, $13,500 all other tiers

Affordable Care Act (ACA) Maximum Once you have reached your out of pocket

maximum during the calendar year, the Unlimited

plan will pay 100% of the eligible expenses

through the end of the year.

Your Weekly Cost for Coverage See rate information on page 19. See rate information on page 19.

Lifetime Maximum No Limit No Limit

Here’s a partial listing of covered expenses under the CDHP Option. Refer to your Summary Plan Description for a complete

listing of covered expenses.

Consumer Driven Health Plan (CDHP) High Deductible PPO Summary of Covered Expense:

Covered Expense In-Network Provider Out-of-Network Provider

Allergy Treatments 90% after deductible 70% of covered charges after

deductible

Ambulance Service 100% when medically necessary; same as in-network

otherwise not covered

Blood Donation 90%; after deductible (when same as in-network

donating for self or

immediate family member)

Chiropractic Care 90% of covered charges 70% of covered charges after

after deductible deductible

Colonoscopy 100%; no deductible same as in-network

Diagnostic X-ray and Lab Services 90% of covered charges after deductible; 70% of covered charges after

deductible

Emergency Room Visits 90% after deductible; $100 co-payment same as in-network

thereafter

Home Health Care 90%; after deductible; requires 70% of covered charges after

pre-certification deductible; requires pre-certification

10