Page 9 - Immucor Benefit Guide

P. 9

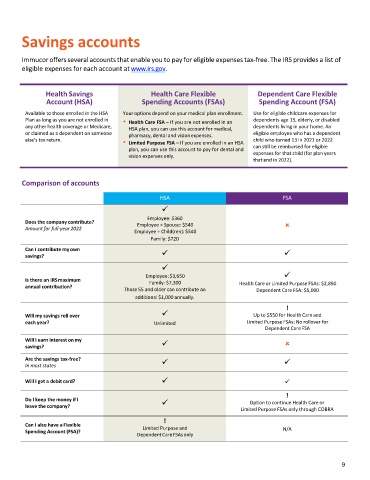

Savings accounts

Immucor offersseveral accounts thatenable you to pay for eligible expenses tax-free.The IRS provides a list of

eligible expenses for each account at www.irs.gov.

Health Savings Health Care Flexible Dependent Care Flexible

Account (HSA) Spending Accounts (FSAs) Spending Account (FSA)

Available to those enrolled in the HSA Your options depend on your medical plan enrollment. Use for eligible childcare expenses for

Plan as long as you are not enrolled in Health Care FSA – If you are not enrolled in an dependents age 13, elderly, or disabled

any other health coverage or Medicare, HSA plan, you can use this account for medical, dependents living in your home. An

or claimed as a dependent on someone pharmacy, dental and visionexpenses. eligible employee who has a dependent

else’s tax return. child who turned 13 in 2021 or 2022

Limited Purpose FSA – If you are enrolled in an HSA

can still be reimbursed for eligible

plan, you can use this account to pay for dental and

expenses for that child (for plan years

vision expenses only.

that end in 2022).

Comparison of accounts

HSA FSA

✓

Employee: $360

Does the company contribute? Employee + Spouse: $540

Amount for full-year 2022

Employee + Child(ren):$540

Family: $720

Can I contribute myown ✓ ✓

savings?

✓

Employee:$3,650 ✓

Is there an IRSmaximum Family: $7,300

annual contribution? Health Care or Limited Purpose FSAs: $2,850

Those 55 and older can contribute an Dependent Care FSA: $5,000

additional $1,000 annually.

!

✓

Will my savings roll over Up to $550 for Health Care and

each year? Unlimited Limited Purpose FSAs; No rollover for

Dependent Care FSA

Will I earn interest onmy ✓

savings?

Are the savings tax-free? ✓ ✓

In most states

Will I get a debit card? ✓ ✓

!

Do I keep the money if I ✓ Option to continue Health Care or

leave the company?

Limited Purpose FSAs only through COBRA

!

Can I also have a Flexible Limited Purpose and

Spending Account (FSA)? N/A

DependentCareFSAsonly

9