Page 12 - 2022 Fives Landis Corp Benefit Guide

P. 12

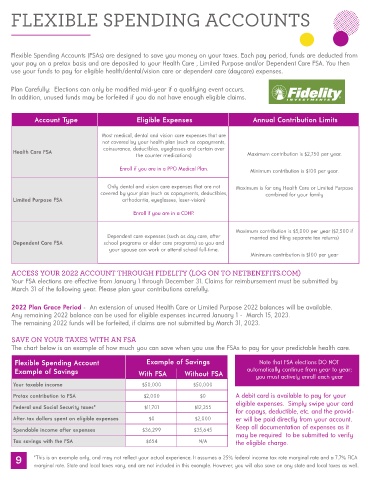

FLEXIBLE SPENDING ACCOUNTS

Flexible Spending Accounts (FSAs) are designed to save you money on your taxes. Each pay period, funds are deducted from

your pay on a pretax basis and are deposited to your Health Care , Limited Purpose and/or Dependent Care FSA. You then

use your funds to pay for eligible health/dental/vision care or dependent care (daycare) expenses.

Plan Carefully: Elections can only be modified mid-year if a qualifying event occurs.

In addition, unused funds may be forfeited if you do not have enough eligible claims.

Account Type Eligible Expenses Annual Contribution Limits

Most medical, dental and vision care expenses that are

not covered by your health plan (such as copayments,

coinsurance, deductibles, eyeglasses and certain over

Health Care FSA Maximum contribution is $2,750 per year.

the counter medications)

Enroll if you are in a PPO Medical Plan. Minimum contribution is $100 per year.

Only dental and vision care expenses that are not Maximum is for any Health Care or Limited Purpose

covered by your plan (such as copayments, deductibles, combined for your family

Limited Purpose FSA orthodontia, eyeglasses, laser-vision)

Enroll if you are in a CDHP.

Maximum contribution is $5,000 per year ($2,500 if

Dependent care expenses (such as day care, after married and filing separate tax returns)

Dependent Care FSA school programs or elder care programs) so you and

your spouse can work or attend school full-time.

Minimum contribution is $100 per year

ACCESS YOUR 2022 ACCOUNT THROUGH FIDELITY (LOG ON TO NETBENEFITS.COM)

Your FSA elections are effective from January 1 through December 31. Claims for reimbursement must be submitted by

March 31 of the following year. Please plan your contributions carefully.

2022 Plan Grace Period - An extension of unused Health Care or Limited Purpose 2022 balances will be available.

Any remaining 2022 balance can be used for eligible expenses incurred January 1 - March 15, 2023.

The remaining 2022 funds will be forfeited, if claims are not submitted by March 31, 2023.

SAVE ON YOUR TAXES WITH AN FSA

The chart below is an example of how much you can save when you use the FSAs to pay for your predictable health care.

Flexible Spending Account Example of Savings Note that FSA elections DO NOT

Example of Savings With FSA Without FSA automatically continue from year to year;

you must actively enroll each year

Your taxable income $50,000 $50,000

Pretax contribution to FSA $2,000 $0 A debit card is available to pay for your

eligible expenses. Simply swipe your card

Federal and Social Security taxes* $11,701 $12,355

for copays, deductible, etc. and the provid-

After-tax dollars spent on eligible expenses $0 $2,000 er will be paid directly from your account.

Keep all documentation of expenses as it

Spendable income after expenses $36,299 $35,645

may be required to be submitted to verify

Tax savings with the FSA $654 N/A the eligible charge.

9 *This is an example only, and may not reflect your actual experience. It assumes a 25% federal income tax rate marginal rate and a 7.7% FICA

marginal rate. State and local taxes vary, and are not included in this example. However, you will also save on any state and local taxes as well.