Page 15 - 2022 Fives Landis Corp Benefit Guide

P. 15

LIFE AND AD&D INSURANCE

Life insurance is an important part of your financial security, especially if others depend on you for support. Accidental Death

& Dismemberment (AD&D) insurance is designed to provide a benefit in the event of accidental death or dismemberment.

The Company provides Basic Life and AD&D Insurance to all eligible employees at no cost to you.

This benefit is one times your annual base earnings rounded up to the nearest $1,000,

up to a maximum benefit of $350,000.

DISABILITY INSURANCE

The Company’s Disability Insurance Plan is to provide you financial protection with income replacement should you become

disabled and unable to work due to a non-work-related illness or injury. The Plan is administered by Voya Financial.

New Hires: Benefits begin the 1st of the month after 90 days.

SHORT-TERM DISABILITY*:

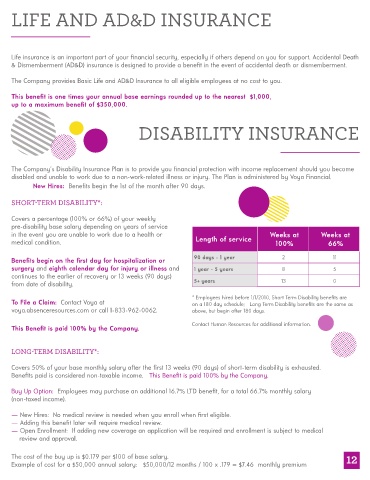

Covers a percentage (100% or 66%) of your weekly

pre-disability base salary depending on years of service

in the event you are unable to work due to a health or Weeks at Weeks at

medical condition. Length of service 100% 66%

Benefits begin on the first day for hospitalization or 90 days - 1 year 2 11

surgery and eighth calendar day for injury or illness and 1 year - 5 years 8 5

continues to the earlier of recovery or 13 weeks (90 days)

from date of disability. 5+ years 13 0

* Employees hired before 1/1/2010, Short Term Disability benefits are

To File a Claim: Contact Voya at on a 180 day schedule; Long Term Disability benefits are the same as

voya.absenceresources.com or call 1-833-962-0062. above, but begin after 180 days.

Contact Human Resources for additional information.

This Benefit is paid 100% by the Company.

LONG-TERM DISABILITY*:

Covers 50% of your base monthly salary after the first 13 weeks (90 days) of short-term disability is exhausted.

Benefits paid is considered non-taxable income. This Benefit is paid 100% by the Company.

Buy Up Option: Employees may purchase an additional 16.7% LTD benefit, for a total 66.7% monthly salary

(non-taxed income).

— New Hires: No medical review is needed when you enroll when first eligible.

— Adding this benefit later will require medical review.

— Open Enrollment: If adding new coverage an application will be required and enrollment is subject to medical

review and approval.

12

The cost of the buy up is $0.179 per $100 of base salary. 10

Example of cost for a $50,000 annual salary: $50,000/12 months / 100 x .179 = $7.46 monthly premium