Page 20 - On Locaiton 2023 Benefit Guide

P. 20

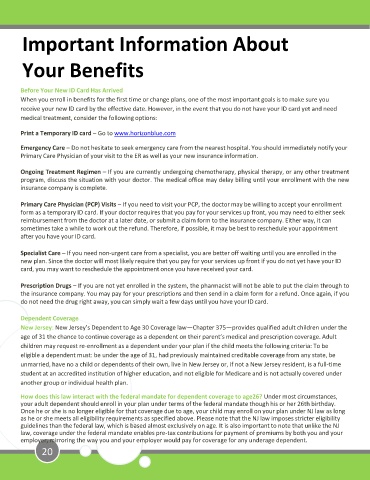

Important Information About

Your Benefits

Before Your New ID Card Has Arrived

When you enroll in benefits for the first time or change plans, one of the most important goals is to make sure you

receive your new ID card by the effective date. However, in the event that you do not have your ID card yet and need

medical treatment, consider the following options:

Print a Temporary ID card – Go to www.horizonblue.com

Emergency Care – Do not hesitate to seek emergency care from the nearest hospital. You should immediately notify your

Primary Care Physician of your visit to the ER as well as your new insurance information.

Ongoing Treatment Regimen – If you are currently undergoing chemotherapy, physical therapy, or any other treatment

program, discuss the situation with your doctor. The medical office may delay billing until your enrollment with the new

insurance company is complete.

Primary Care Physician (PCP) Visits – If you need to visit your PCP, the doctor may be willing to accept your enrollment

form as a temporary ID card. If your doctor requires that you pay for your services up front, you may need to either seek

reimbursement from the doctor at a later date, or submit a claim form to the insurance company. Either way, it can

sometimes take a while to work out the refund. Therefore, if possible, it may be best to reschedule your appointment

after you have your ID card.

Specialist Care – If you need non-urgent care from a specialist, you are better off waiting until you are enrolled in the

new plan. Since the doctor will most likely require that you pay for your services up front if you do not yet have your ID

card, you may want to reschedule the appointment once you have received your card.

Prescription Drugs – If you are not yet enrolled in the system, the pharmacist will not be able to put the claim through to

the insurance company. You may pay for your prescriptions and then send in a claim form for a refund. Once again, if you

do not need the drug right away, you can simply wait a few days until you have your ID card.

Dependent Coverage

New Jersey: New Jersey’s Dependent to Age 30 Coverage law—Chapter 375—provides qualified adult children under the

age of 31 the chance to continue coverage as a dependent on their parent’s medical and prescription coverage. Adult

children may request re-enrollment as a dependent under your plan if the child meets the following criteria: To be

eligible a dependent must: be under the age of 31, had previously maintained creditable coverage from any state, be

unmarried, have no a child or dependents of their own, live in New Jersey or, if not a New Jersey resident, is a full-time

student at an accredited institution of higher education, and not eligible for Medicare and is not actually covered under

another group or individual health plan.

How does this law interact with the federal mandate for dependent coverage to age26? Under most circumstances,

your adult dependent should enroll in your plan under terms of the federal mandate though his or her 26th birthday.

Once he or she is no longer eligible for that coverage due to age, your child may enroll on your plan under NJ law as long

as he or she meets all eligibility requirements as specified above. Please note that the NJ law imposes stricter eligibility

guidelines than the federal law, which is based almost exclusively on age. It is also important to note that unlike the NJ

law, coverage under the federal mandate enables pre-tax contributions for payment of premiums by both you and your

employer, mirroring the way you and your employer would pay for coverage for any underage dependent.

20