Page 7 - Interior Architects-2022-23-Benefit Guide

P. 7

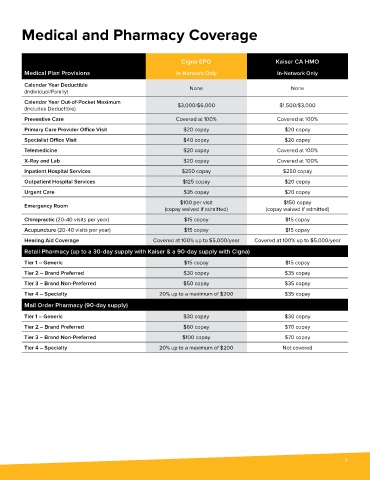

Medical and Pharmacy Coverage

Cigna EPO Kaiser CA HMO

Medical Plan Provisions In-Network Only In-Network Only

Calendar Year Deductible None None

(Individual/Family)

Calendar Year Out-of-Pocket Maximum

(Includes Deductible) $3,000/$6,000 $1,500/$3,000

Preventive Care Covered at 100% Covered at 100%

Primary Care Provider Office Visit $20 copay $20 copay

Specialist Office Visit $40 copay $20 copay

Telemedicine $20 copay Covered at 100%

X-Ray and Lab $20 copay Covered at 100%

Inpatient Hospital Services $250 copay $250 copay

Outpatient Hospital Services $125 copay $20 copay

Urgent Care $35 copay $20 copay

$100 per visit $150 copay

Emergency Room

(copay waived if admitted) (copay waived if admitted)

Chiropractic (20-40 visits per year) $15 copay $15 copay

Acupuncture (20-40 visits per year) $15 copay $15 copay

Hearing Aid Coverage Covered at 100% up to $5,000/year Covered at 100% up to $5,000/year

Retail Pharmacy (up to a 30-day supply with Kaiser & a 90-day supply with Cigna)

Tier 1 – Generic $15 copay $15 copay

Tier 2 – Brand Preferred $30 copay $35 copay

Tier 3 – Brand Non-Preferred $50 copay $35 copay

Tier 4 – Specialty 20% up to a maximum of $200 $35 copay

Mail Order Pharmacy (90-day supply)

Tier 1 – Generic $30 copay $30 copay

Tier 2 – Brand Preferred $60 copay $70 copay

Tier 3 – Brand Non-Preferred $100 copay $70 copay

Tier 4 – Specialty 20% up to a maximum of $200 Not covered

7