Page 9 - Emmis 2022 Benefit Guide

P. 9

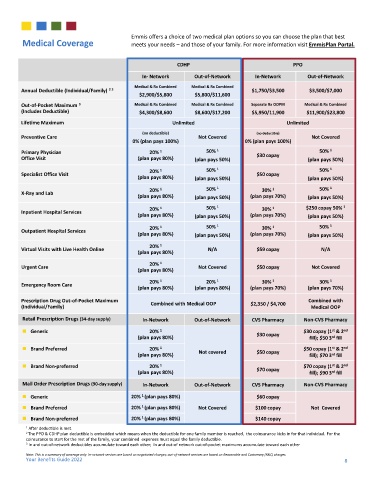

Emmis offers a choice of two medical plan options so you can choose the plan that best

Medical Coverage meets your needs – and those of your family. For more information visit EmmisPlan Portal.

CDHP PPO

In- Network Out-of-Network In-Network Out-of-Network

Medical & Rx Combined Medical & Rx Combined

Annual Deductible (Individual/Family) 2 3 $1,750/$3,500 $3,500/$7,000

$2,900/$5,800 $5,800/$11,600

Out-of-Pocket Maximum 3 Medical & Rx Combined Medical & Rx Combined Separate Rx OOPM Medical & Rx Combined

(Includes Deductible) $4,300/$8,600 $8,600/$17,200 $5,950/11,900 $11,900/$23,800

Lifetime Maximum Unlimited Unlimited

(no deductible) (no deductible)

Preventive Care Not Covered Not Covered

0% (plan pays 100%) 0% (plan pays 100%)

Primary Physician 20% 1 50% 1 $30 copay 50% 1

Office Visit (plan pays 80%) (plan pays 50%) (plan pays 50%)

20% 1 50% 1 50% 1

Specialist Office Visit $50 copay

(plan pays 80%) (plan pays 50%) (plan pays 50%)

20% 1 50% 1 30% 1 50% 1

X-Ray and Lab

(plan pays 80%) (plan pays 50%) (plan pays 70%) (plan pays 50%)

20% 1 50% 1 30% 1 $250 copay 50% 1

Inpatient Hospital Services

(plan pays 80%) (plan pays 50%) (plan pays 70%) (plan pays 50%)

20% 1 50% 1 30% 1 50% 1

Outpatient Hospital Services

(plan pays 80%) (plan pays 50%) (plan pays 70%) (plan pays 50%)

20% 1

Virtual Visits with Live Health Online N/A $59 copay N/A

(plan pays 80%)

20% 1

Urgent Care Not Covered $50 copay Not Covered

(plan pays 80%)

20% 1 20% 1 30% 1 30% 1

Emergency Room Care

(plan pays 80%) (plan pays 80%) (plan pays 70%) (plan pays 70%)

Prescription Drug Out-of-Pocket Maximum Combined with Medical OOP $2,350 / $4,700 Combined with

(Individual/Family) Medical OOP

Retail Prescription Drugs (34-day supply) In-Network Out-of-Network CVS Pharmacy Non-CVS Pharmacy

st

◼ Generic 20% 1 $30 copay $30 copay (1 & 2 nd

(plan pays 80%) fill); $50 3 fill

rd

st

◼ Brand Preferred 20% 1 $50 copay (1 & 2 nd

rd

(plan pays 80%) Not covered $50 copay fill); $70 3 fill

◼ Brand Non-preferred 20% 1 $70 copay (1 & 2 nd

st

(plan pays 80%) $70 copay fill); $90 3 fill

rd

Mail Order Prescription Drugs (90-day supply) In-Network Out-of-Network CVS Pharmacy Non-CVS Pharmacy

1

◼ Generic 20% (plan pays 80%) $60 copay

1

◼ Brand Preferred 20% (plan pays 80%) Not Covered $100 copay Not Covered

1

◼ Brand Non-preferred 20% (plan pays 80%) $140 copay

1 After deductible is met.

2 The PPO & CDHP plan deductible is embedded which means when the deductible for one family member is reached, the coinsurance kicks in for that individual. For the

coinsurance to start for the rest of the family, your combined expenses must equal the family deductible.

3 In and out-of-network deductibles accumulate toward each other; In and out-of network out-of-pocket maximums accumulate toward each other

Note: This is a summary of coverage only. In-network services are based on negotiated charges; out-of-network services are based on Reasonable and Customary (R&C) charges.

Your Benefits Guide 2022 8