Page 27 - 2022_Benefits_Book_Encharter_v9

P. 27

i 866-451-3399

wexinc.com

Your Contributions Flexible Spending Accounts

You can contribute to your 401(k) Plan account through payroll deductions on a pre-tax and/or traditional after-tax

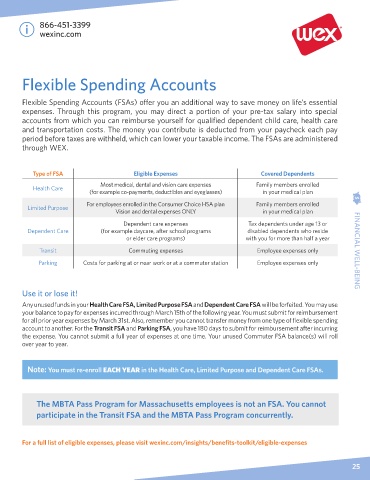

basis. Flexible Spending Accounts (FSAs) offer you an additional way to save money on life’s essential

expenses. Through this program, you may direct a portion of your pre-tax salary into special

Contribution Vesting accounts from which you can reimburse yourself for qualified dependent child care, health care

Vesting refers to your ownership of money in your Plan account. All contributions to your 401(k) Plan account are fully and transportation costs. The money you contribute is deducted from your paycheck each pay

vested with the exception of matching contributions. Your matching contributions are 20% vested after two years period before taxes are withheld, which can lower your taxable income. The FSAs are administered

of service and vest another 20% each year thereafter. When you have completed six years of service your existing through WEX.

matching contributions, as well as future matching contributions deposited into your account, are 100% yours.

Your Investment Choices

Type of FSA Eligible Expenses Covered Dependents

To initiate a rollover into the Plymouth Rock 401(k) Plan Limited Purpose For employees enrolled in the Consumer Choice HSA plan Family members enrolled

Most medical, dental and vision care expenses

Health Care

(for example co-payments, deductibles and eyeglasses)

in your medical plan

FINANCIAL WELL-BEING Step 2: Log in to your Vanguard account to initiate the rollover deposit. After completing the steps online, you will Dependent Care (for example daycare, after school programs with you for more than half a year FINANCIAL WELL-BEING

Step 1: Contact your former 401(k) plan administrator (i.e. Fidelity) to request a rollover distribution.

Family members enrolled

The check should include Plan #092016 and be made payable to Vanguard Fiduciary Trust Company, For

in your medical plan

Vision and dental expenses ONLY

the benefit of [your name]

Tax dependents under age 13 or

Dependent care expenses

disabled dependents who reside

be prompted to print a form.

or elder care programs)

Step 3: Mail the form and the check to: Vanguard, ATTN: Plan # 092016, P.O. Box 982902 El Paso, TX 79998-2902

Transit

Employee expenses only

Commuting expenses

You decide how to invest your funds in your 401(k) Plan account by choosing from a broad range of Vanguard mutual

funds. The Vanguard funds available to you include a variety of asset classes with different levels of investment return Parking Costs for parking at or near work or at a commuter station Employee expenses only

and risk.

Use it or lose it!

Importance of Diversification Any unused funds in your Health Care FSA, Limited Purpose FSA and Dependent Care FSA will be forfeited. You may use

Diversification means spreading your investments among different asset classes to manage and control risk. your balance to pay for expenses incurred through March 15th of the following year. You must submit for reimbursement

Vanguard makes diversification easy! for all prior year expenses by March 31st. Also, remember you cannot transfer money from one type of flexible spending

account to another. For the Transit FSA and Parking FSA, you have 180 days to submit for reimbursement after incurring

Target Date Retirement Funds: These funds offer the simplicity of a balanced portfolio in a single fund. Each fund invests the expense. You cannot submit a full year of expenses at one time. Your unused Commuter FSA balance(s) will roll

in several broadly diversified Vanguard funds. As the target date in the fund’s name draws near, its investment mix over year to year.

becomes more conservative. Through this approach, a single Target Retirement Fund is meant to serve you throughout

your career and retirement. Target Retirement Funds are the default funds in the Plan.

Fund Research: Find fact sheets, prospectuses, and much more information on the funds available in the Plan. Note: You must re-enroll EACH YEAR in the Health Care, Limited Purpose and Dependent Care FSAs.

Are you age 55 or older and have investment questions? Ask a CFP professional.

®

If you are age 55 or older, Vanguard Financial Planning Services can directly connect you with a Certified Financial

Planner free of charge. You may speak with a CFP professional today at 800-310-8952. The MBTA Pass Program for Massachusetts employees is not an FSA. You cannot

participate in the Transit FSA and the MBTA Pass Program concurrently.

For a full list of eligible expenses, please visit wexinc.com/insights/benefits-toolkit/eligible-expenses

24 25