Page 472 - FY 2021-22 Adopted Budget file_Neat

P. 472

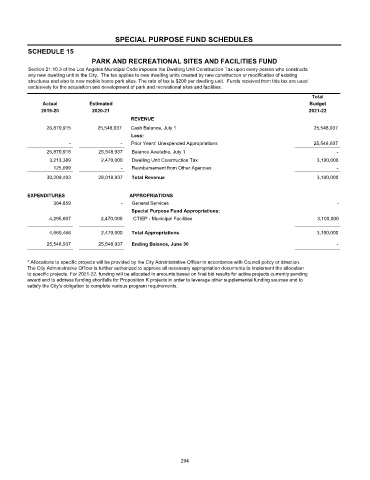

SPECIAL PURPOSE FUND SCHEDULES

SCHEDULE 15

PARK AND RECREATIONAL SITES AND FACILITIES FUND

Section 21.10.3 of the Los Angeles Municipal Code imposes the Dwelling Unit Construction Tax upon every person who constructs

any new dwelling unit in the City. The tax applies to new dwelling units created by new construction or modification of existing

structures and also to new mobile home park sites. The rate of tax is $200 per dwelling unit. Funds received from this tax are used

exclusively for the acquisition and development of park and recreational sites and facilities.

Total

Actual Estimated Budget

2019-20 2020-21 2021-22

REVENUE

26,870,915 25,548,937 Cash Balance, July 1 25,548,937

Less:

- - PYUNEXPAPPR1 Prior Years' Unexpended Appropriations 25,548,937

26,870,915 25,548,937 Balance Available, July 1 -

3,213,389 2,470,000 11,741 Dwelling Unit Construction Tax 3,100,000

125,099 - 11,806 Reimbursement from Other Agencies -

30,209,403 28,018,937 Total Revenue 3,100,000

EXPENDITURES APPROPRIATIONS

364,859 - 383 General Services -

Special Purpose Fund Appropriations:

4,295,607 2,470,000 860 CTIEP - Municipal Facilities 3,100,000

4,660,466 2,470,000 Total Appropriations 3,100,000

25,548,937 25,548,937 Ending Balance, June 30 -

* Allocations to specific projects will be provided by the City Administrative Officer in accordance with Council policy or direction.

The City Administrative Officer is further authorized to approve all necessary appropriation documents to implement the allocation

to specific projects. For 2021-22, funding will be allocated in amounts based on final bid results for active projects currently pending

award and to address funding shortfalls for Proposition K projects in order to leverage other supplemental funding sources and to

satisfy the City's obligation to complete various program requirements.

294