Page 31 - 87099_NSAA_ JournalSpring2019_Online File2_Neat

P. 31

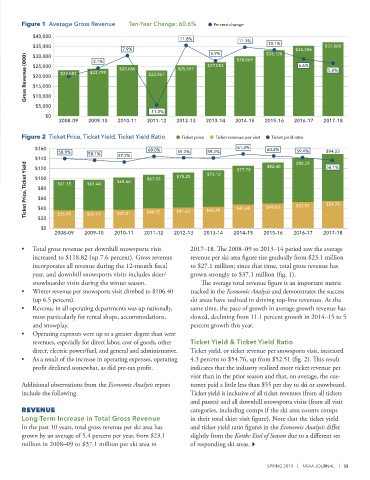

NSAA Figure 1 Average Gross Revenue Ten-Year Change: 60.6% Percent change

$40,000

$40,000

11.8%

11.1% 10.1%

$35,000

$35,000 $37,068

7.9% 5.9% $30,069 $33,120 $35,306

Gross Revenue (000) $25,000 $23,083 $23,799 $25,680 $22,867 $25,557 $27,053 6.6% 5.0%

$30,000

$30,000

3.1%

$25,000

$20,000

$20,000

$15,000

$15,000

$10,000

$10,000

$5,000

$5,000

-11.0%

$0

$0

2008–09 2009–10 2010–11 2011–12 2012–13 2013–14 2014–15 2015–16 2016–17 2017–18

2008–09

2009–10

2013–14

2012–13

2014–15

2011–12

2016–17

2015–16

2010–11

2017–18

FINAL RESULTS Breakdown of the Figure 2 Ticket Price, Ticket Yield, Ticket Yield Ratio Ticket price Ticket revenue per visit 60.2%

Ticket yield ratio

2017–18 Season

61.2%

$160

60.0%

59.4%

$140 58.9% 58.1% 57.2% 59.3% 59.2% $88.39 $94.23

Ticket Price, Ticket Yield $80 $61.15 $61.44 $47.60 $49.59 $52.51 $54.76

BY DAVE BELIN, DIRECTOR OF CONSULTING SERVICES, RRC ASSOCIATES $120 $64.66 $67.03 $70.28 $73.12 $77.79 $82.40 58.1%

$100

$60

$40

$20

$0 $35.99 $35.71 $37.01 $40.22 $41.67 $43.29

2008–09 2009–10 2010–11 2011–12 2012–13 2013–14 2014–15 2015–16 2016–17 2017–18

• Total gross revenue per downhill snowsports visit 2017–18. The 2008–09 to 2013–14 period saw the average

increased to $118.82 (up 7.6 percent). Gross revenue revenue per ski area figure rise gradually from $23.1 million

incorporates all revenue during the 12-month fiscal to $27.1 million; since that time, total gross revenue has

year, and downhill snowsports visits includes skier/ grown strongly to $37.1 million (fig. 1).

snowboarder visits during the winter season. The average total revenue figure is an important metric

• Winter revenue per snowsports visit climbed to $106.40 tracked in the Economic Analysis and demonstrates the success

(up 6.5 percent). ski areas have realized in driving top-line revenues. At the

• Revenue in all operating departments was up nationally, same time, the pace of growth in average growth revenue has

most particularly for rental shops, accommodations, slowed, declining from 11.1 percent growth in 2014–15 to 5

and snowplay. percent growth this year.

• Operating expenses were up to a greater degree than were

revenues, especially for direct labor, cost of goods, other Ticket Yield & Ticket Yield Ratio

direct, electric power/fuel, and general and administrative. Ticket yield, or ticket revenue per snowsports visit, increased

• As a result of the increase in operating expenses, operating 4.3 percent to $54.76, up from $52.51 (fig. 2). This result

profit declined somewhat, as did pre-tax profit. indicates that the industry realized more ticket revenue per

visit than in the prior season and that, on average, the cus-

Additional observations from the Economic Analysis report tomer paid a little less than $55 per day to ski or snowboard.

include the following. Ticket yield is inclusive of all ticket revenues (from all tickets

and passes) and all downhill snowsports visits (from all visit

REVENUE categories, including comps if the ski area counts comps

Long-Term Increase in Total Gross Revenue in their total skier visit figure). Note that the ticket yield

In the past 10 years, total gross revenue per ski area has and ticket yield ratio figures in the Economic Analysis differ

grown by an average of 5.4 percent per year, from $23.1 slightly from the Kottke End of Season due to a different set

million in 2008–09 to $37.1 million per ski area in of responding ski areas.

SPRING 2019 | NSAA JOURNAL | 29