Page 5 - Appraisal 2018

P. 5

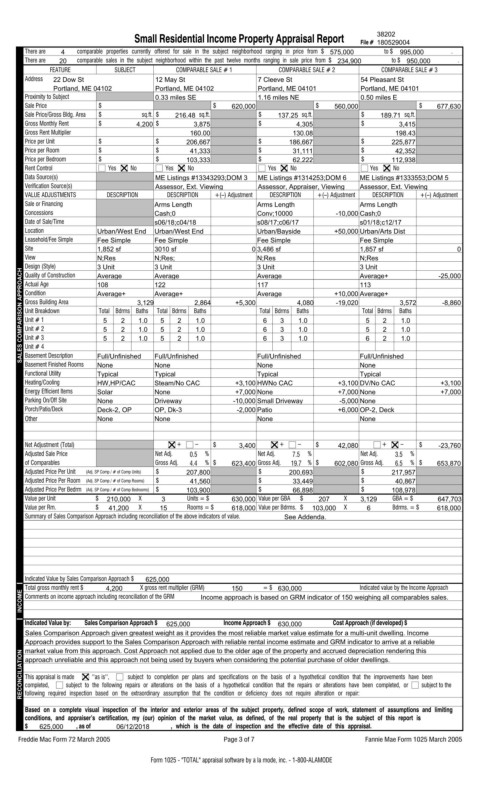

Small Residential Income Property Appraisal Report File # 38202

180529004

There are 4 comparable properties currently offered for sale in the subject neighborhood ranging in price from $ 575,000 to $ 995,000 .

There are 20 comparable sales in the subject neighborhood within the past twelve months ranging in sale price from $ 234,900 to $ 950,000 .

FEATURE SUBJECT COMPARABLE SALE # 1 COMPARABLE SALE # 2 COMPARABLE SALE # 3

Address 22 Dow St 12 May St 7 Cleeve St 54 Pleasant St

Portland, ME 04102 Portland, ME 04102 Portland, ME 04101 Portland, ME 04101

Proximity to Subject 0.33 miles SE 1.16 miles NE 0.50 miles E

Sale Price $ $ 620,000 $ 560,000 $ 677,630

Sale Price/Gross Bldg. Area $ sq.ft. $ 216.48 sq.ft. $ 137.25 sq.ft. $ 189.71 sq.ft.

Gross Monthly Rent $ 4,200 $ 3,875 $ 4,305 $ 3,415

Gross Rent Multiplier 160.00 130.08 198.43

Price per Unit $ $ 206,667 $ 186,667 $ 225,877

Price per Room $ $ 41,333 $ 31,111 $ 42,352

Price per Bedroom $ $ 103,333 $ 62,222 $ 112,938

Rent Control Yes No Yes No Yes No Yes No

Data Source(s) ME Listings #13343293;DOM 3 ME Listings #1314253;DOM 6 ME Listings #1333553;DOM 5

Verification Source(s) Assessor, Ext. Viewing Assessor, Appraiser, Viewing Assessor, Ext. Viewing

VALUE ADJUSTMENTS DESCRIPTION DESCRIPTION +(–) Adjustment DESCRIPTION +(–) Adjustment DESCRIPTION +(–) Adjustment

Sale or Financing Arms Length Arms Length Arms Length

Concessions Cash;0 Conv;10000 -10,000 Cash;0

Date of Sale/Time s06/18;c04/18 s08/17;c06/17 s01/18;c12/17

Location Urban/West End Urban/West End Urban/Bayside +50,000 Urban/Arts Dist

Leasehold/Fee Simple Fee Simple Fee Simple Fee Simple Fee Simple

Site 1,852 sf 3010 sf 0 3,486 sf 1,857 sf 0

View N;Res N;Res; N;Res N;Res -25,000

SALES COMPARISON APPROACH Design (Style) Average+ 3,129 Average+ Baths +5,300 Average 3 Baths +10,000 Average+ Baths -8,860

3 Unit

3 Unit

3 Unit

3 Unit

Quality of Construction

Average+

Average

Average

Average

Actual Age

117

113

108

122

Condition

Gross Building Area

3,572

2,864

-19,020

4,080

Total Bdrms

Total Bdrms

Total Bdrms Baths

Total Bdrms

Unit Breakdown

Unit # 1

2

2

5

5

1.0

5

2

6

1.0

1.0

1.0

Unit # 2

2

5

5

1.0

1.0

5

6

3

1.0

2

2

1.0

Unit # 3

6

1.0

3

6

1.0

5

2

2

2

5

1.0

1.0

Unit # 4

Basement Description

Basement Finished Rooms Full/Unfinished Full/Unfinished Full/Unfinished Full/Unfinished

None

None

None

None

Functional Utility Typical Typical Typical Typical

Heating/Cooling HW,HP/CAC Steam/No CAC +3,100 HWNo CAC +3,100 DV/No CAC +3,100

Energy Efficient Items Solar None +7,000 None +7,000 None +7,000

Parking On/Off Site None Driveway -10,000 Small Driveway -5,000 None

Porch/Patio/Deck Deck-2, OP OP, Dk-3 -2,000 Patio +6,000 OP-2, Deck

Other None None None None

Net Adjustment (Total) + – $ 3,400 + – $ 42,080 + – $ -23,760

Adjusted Sale Price Net Adj. 0.5 % Net Adj. 7.5 % Net Adj. 3.5 %

of Comparables Gross Adj. 4.4 % $ 623,400 Gross Adj. 19.7 % $ 602,080 Gross Adj. 6.5 % $ 653,870

Adjusted Price Per Unit (Adj. SP Comp / # of Comp Units) $ 207,800 $ 200,693 $ 217,957

Adjusted Price Per Room (Adj. SP Comp / # of Comp Rooms) $ 41,560 $ 33,449 $ 40,867

Adjusted Price Per Bedrm (Adj. SP Comp / # of Comp Bedrooms) $ 103,900 $ 66,898 $ 108,978

Value per Unit $ 210,000 X 3 Units = $ 630,000 Value per GBA $ 207 X 3,129 GBA = $ 647,703

Value per Rm. $ 41,200 X 15 Rooms = $ 618,000 Value per Bdrms. $ 103,000 X 6 Bdrms. = $ 618,000

Summary of Sales Comparison Approach including reconciliation of the above indicators of value. See Addenda.

Indicated Value by Sales Comparison Approach $ X gross rent multiplier (GRM) = $ Indicated value by the Income Approach

625,000

INCOME Total gross monthly rent $ 4,200 Income approach is based on GRM indicator of 150 weighing all comparables sales.

150

630,000

Comments on income approach including reconciliation of the GRM

Indicated Value by: Sales Comparison Approach $ 625,000 Income Approach $ 630,000 Cost Approach (if developed) $

Sales Comparison Approach given greatest weight as it provides the most reliable market value estimate for a multi-unit dwelling. Income

Approach provides support to the Sales Comparison Approach with reliable rental income estimate and GRM indicator to arrive at a reliable

market value from this approach. Cost Approach not applied due to the older age of the property and accrued depreciation rendering this

RECONCILIATION approach unreliable and this approach not being used by buyers when considering the potential purchase of older dwellings. subject to the

''as is'',

This appraisal is made

subject to completion per plans and specifications on the basis of a hypothetical condition that the improvements have been

subject to the following repairs or alterations on the basis of a hypothetical condition that the repairs or alterations have been completed, or

completed,

following required inspection based on the extraordinary assumption that the condition or deficiency does not require alteration or repair:

Based on a complete visual inspection of the interior and exterior areas of the subject property, defined scope of work, statement of assumptions and limiting

conditions, and appraiser’s certification, my (our) opinion of the market value, as defined, of the real property that is the subject of this report is

$ 625,000 , as of 06/12/2018 , which is the date of inspection and the effective date of this appraisal.

Freddie Mac Form 72 March 2005 Page 3 of 7 Fannie Mae Form 1025 March 2005

Form 1025 - "TOTAL" appraisal software by a la mode, inc. - 1-800-ALAMODE