Page 6 - Appraisal 2018

P. 6

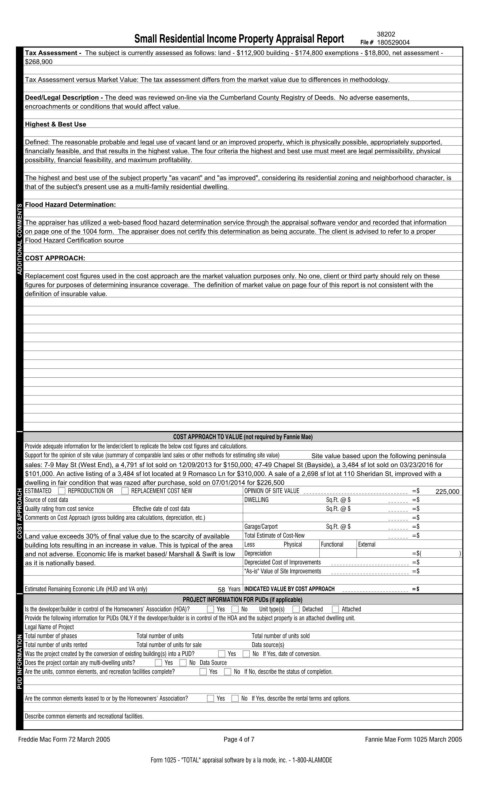

Small Residential Income Property Appraisal Report File # 38202

180529004

Tax Assessment - The subject is currently assessed as follows: land - $112,900 building - $174,800 exemptions - $18,800, net assessment -

$268,900

Tax Assessment versus Market Value: The tax assessment differs from the market value due to differences in methodology.

Deed/Legal Description - The deed was reviewed on-line via the Cumberland County Registry of Deeds. No adverse easements,

encroachments or conditions that would affect value.

Highest & Best Use

Defined: The reasonable probable and legal use of vacant land or an improved property, which is physically possible, appropriately supported,

financially feasible, and that results in the highest value. The four criteria the highest and best use must meet are legal permissibility, physical

possibility, financial feasibility, and maximum profitability.

The highest and best use of the subject property "as vacant" and "as improved", considering its residential zoning and neighborhood character, is

that of the subject's present use as a multi-family residential dwelling.

Flood Hazard Determination:

ADDITIONAL COMMENTS The appraiser has utilized a web-based flood hazard determination service through the appraisal software vendor and recorded that information

on page one of the 1004 form. The appraiser does not certify this determination as being accurate. The client is advised to refer to a proper

Flood Hazard Certification source

COST APPROACH:

Replacement cost figures used in the cost approach are the market valuation purposes only. No one, client or third party should rely on these

figures for purposes of determining insurance coverage. The definition of market value on page four of this report is not consistent with the

definition of insurable value.

COST APPROACH TO VALUE (not required by Fannie Mae)

Provide adequate information for the lender/client to replicate the below cost figures and calculations.

Support for the opinion of site value (summary of comparable land sales or other methods for estimating site value) Site value based upon the following peninsula

sales: 7-9 May St (West End), a 4,791 sf lot sold on 12/09/2013 for $150,000; 47-49 Chapel St (Bayside), a 3,484 sf lot sold on 03/23/2016 for

$101,000. An active listing of a 3,484 sf lot located at 9 Romasco Ln for $310,000. A sale of a 2,698 sf lot at 110 Sheridan St, improved with a

dwelling in fair condition that was razed after purchase, sold on 07/01/2014 for $226,500 =$ 225,000

OPINION OF SITE VALUE

COST APPROACH Source of cost data Effective date of cost data DWELLING Sq.Ft. @ $ =$

REPRODUCTION OR

ESTIMATED

REPLACEMENT COST NEW

Sq.Ft. @ $

Quality rating from cost service

=$

Comments on Cost Approach (gross building area calculations, depreciation, etc.)

=$

=$

Garage/Carport

Sq.Ft. @ $

Land value exceeds 30% of final value due to the scarcity of available

Physical

Less

building lots resulting in an increase in value. This is typical of the area Total Estimate of Cost-New Functional External =$

and not adverse. Economic life is market based/ Marshall & Swift is low Depreciation =$( )

as it is nationally based. Depreciated Cost of Improvements =$

"As-is" Value of Site Improvements =$

Estimated Remaining Economic Life (HUD and VA only) 58 Years INDICATED VALUE BY COST APPROACH =$

PROJECT INFORMATION FOR PUDs (if applicable)

Is the developer/builder in control of the Homeowners’ Association (HOA)? Yes No Unit type(s) Detached Attached

Provide the following information for PUDs ONLY if the developer/builder is in control of the HOA and the subject property is an attached dwelling unit.

Legal Name of Project Total number of units Total number of units sold

Total number of phases

PUD INFORMATION Total number of units rented Total number of units for sale Yes Yes No If No, describe the status of completion.

Data source(s)

No If Yes, date of conversion.

Was the project created by the conversion of existing building(s) into a PUD?

Yes

No Data Source

Does the project contain any multi-dwelling units?

Are the units, common elements, and recreation facilities complete?

Are the common elements leased to or by the Homeowners’ Association? Yes No If Yes, describe the rental terms and options.

Describe common elements and recreational facilities.

Freddie Mac Form 72 March 2005 Page 4 of 7 Fannie Mae Form 1025 March 2005

Form 1025 - "TOTAL" appraisal software by a la mode, inc. - 1-800-ALAMODE