Page 11 - B2BAAG15_Affinity Lending Brochure

P. 11

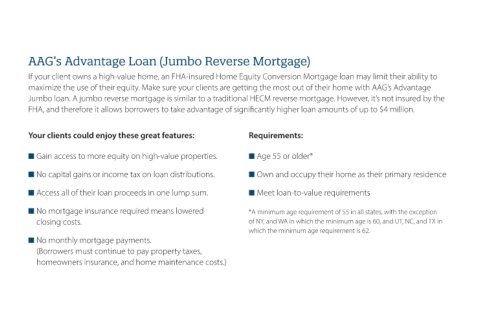

If your client owns a high-value home, an FHA-insured Home Equity Conversion Mortgage loan may limit their ability to

maximize the use of their equity. Make sure your clients are getting the most out of their home with AAG’s Advantage

Jumbo loan. A jumbo reverse mortgage is similar to a traditional HECM reverse mortgage. However, it’s not insured by the

FHA, and therefore it allows borrowers to take advantage of significantly higher loan amounts of up to $4 million.

Your clients could enjoy these great features: Requirements:

n Gain access to more equity on high-value properties. n Age 55 or older*

n No capital gains or income tax on loan distributions. n Own and occupy their home as their primary residence

n Access all of their loan proceeds in one lump sum. n Meet loan-to-value requirements

n No mortgage insurance required means lowered *A minimum age requirement of 55 in all states, with the exception

closing costs. of NY, and WA in which the minimum age is 60, and UT, NC, and TX in

which the minimum age requirement is 62.

n No monthly mortgage payments.

(Borrowers must continue to pay property taxes,

homeowners insurance, and home maintenance costs.)