Page 245 - Corporate Finance PDF Final new link

P. 245

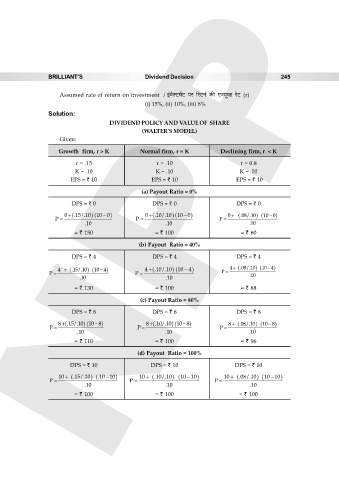

BRILLIANT’S Dividend Decision 245

Assumed rate of return on investment / B§doñQ>‘|Q> na [aQ>Z© H$s EÁ¶yåS> aoQ> (r)

(i) 15%, (ii) 10%, (iii) 8%

Solution:

DIVIDEND POLICY AND VALUE OF SHARE

(WALTER'S MODEL)

Given:

Growth firm, r > K Normal firm, r = K Declining firm, r < K

r = .15 r = .10 r = 0.8

K = .10 K = .10 K = .10

EPS = ` 10 EPS = ` 10 EPS = ` 10

(a) Payout Ratio = 0%

DPS = ` 0 DPS = ` 0 DPS = ` 0

0 .15/.10 10 0 NPP 0 .10/.10 10 0 0 .08/.10

10 0

P P P

.10 .10 .10

= ` 150 = ` 100 = ` 80

(b) Payout Ratio = 40%

DPS = ` 4 DPS = ` 4 DPS = ` 4

4 .15/.10 4 .10/.10 10 4 4 .08/.10 10 4

10 4

P P P .10

.10 .10

= ` 130 = ` 100 = ` 88

(c) Payout Ratio = 80%

DPS = ` 8 DPS = ` 8 DPS = ` 8

8 .15/.10 10 8 8 .10/.10 10 8 8 .08/.10

10 8

P P P

.10 .10 .10

= ` 110 = ` 100 = ` 96

(d) Payout Ratio = 100%

DPS = ` 10 DPS = ` 10 DPS = ` 10

10 .15/.10 .10 10 10 .10/.10 10 10 10 .08/.10 10 10

P P P

.10 .10 .10

= ` 100 = ` 100 = ` 100