Page 429 - Corporate Finance PDF Final new link

P. 429

BRILLIANT’S Capital Budgeting 429

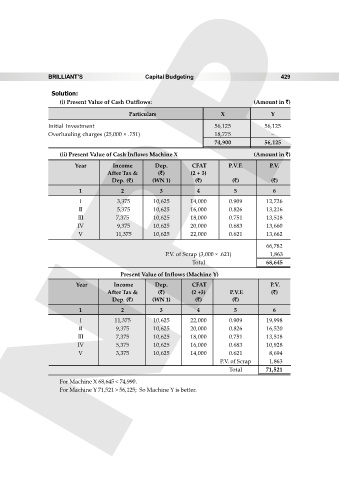

Solution:

(i) Present Value of Cash Outflows: (Amount in `)

Particulars X Y

Initial Investment 56,125 56,125

Overhauling charges (25,000 × .751) 18,775 –

74,900 56,125

(ii) Present Value of Cash Inflows Machine X (Amount in `)

Year Income Dep. CFAT P.V.F. P.V.

After Tax & (`) (2 + 3)

Dep. (`) (WN 1) (`) (`) (`)

1 2 3 4 5 6

I 3,375 10,625 14,000 0.909 12,726

II 5,375 10,625 16,000 0.826 13,216

7,375

III NPP 10,625 18,000 0.751 13,518

IV 9,375 10,625 20,000 0.683 13,660

V 11,375 10,625 22,000 0.621 13,662

66,782

P.V. of Scrap (3,000 × .621) 1,863

Total 68,645

Present Value of Inflows (Machine Y)

Year Income Dep. CFAT P.V.

After Tax & (`) (2 +3) P.V.F. (`)

Dep. (`) (WN 1) (`) (`)

1 2 3 4 5 6

I 11,375 10,625 22,000 0.909 19,998

II 9,375 10,625 20,000 0.826 16,520

III 7,375 10,625 18,000 0.751 13,518

IV 5,375 10,625 16,000 0.683 10,928

V 3,375 10,625 14,000 0.621 8,694

P.V. of Scrap 1,863

Total 71,521

For Machine X 68,645 < 74,990.

For Machine Y 71,521 > 56,125; So Machine Y is better.