Page 449 - Corporate Finance PDF Final new link

P. 449

BRILLIANT’S Capital Budgeting 449

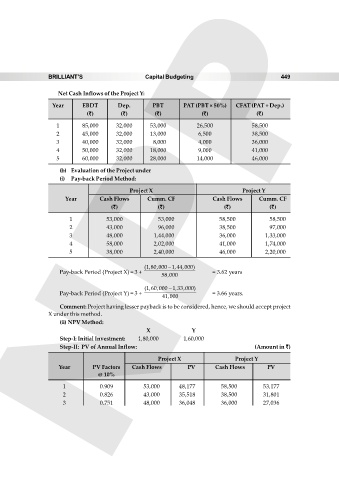

Net Cash Inflows of the Project Y:

Year EBDT Dep. PBT PAT (PBT × 50%) CFAT (PAT + Dep.)

(`) (`) (`) (`) (`)

1 85,000 32,000 53,000 26,500 58,500

2 45,000 32,000 13,000 6,500 38,500

3 40,000 32,000 8,000 4,000 36,000

4 50,000 32,000 18,000 9,000 41,000

5 60,000 32,000 28,000 14,000 46,000

(b) Evaluation of the Project under

(i) Pay-back Period Method:

Project X Project Y

Year Cash Flows Cumm. CF Cash Flows Cumm. CF

(`) (`) (`) (`)

53,000

1 NPP 53,000 58,500 58,500

2 43,000 96,000 38,500 97,000

3 48,000 1,44,000 36,000 1,33,000

4 58,000 2,02,000 41,000 1,74,000

5 38,000 2,40,000 46,000 2,20,000

(1,80,000 1,44,000)

Pay-back Period (Project X) = 3 + = 3.62 years

58,000

(1,60,000 1,33,000)

Pay-back Period (Project Y) = 3 + = 3.66 years.

41,000

Comment: Project having lesser payback is to be considered, hence, we should accept project

X under this method.

(ii) NPV Method:

X Y

Step-I: Initial Investment: 1,80,000 1,60,000

Step-II: PV of Annual Inflow: (Amount in `)

Project X Project Y

Year PV Factors Cash Flows PV Cash Flows PV

@ 10%

1 0.909 53,000 48,177 58,500 53,177

2 0.826 43,000 35,518 38,500 31,801

3 0.751 48,000 36,048 36,000 27,036