Page 34 - The History of Watertown Savings Bank_Neat

P. 34

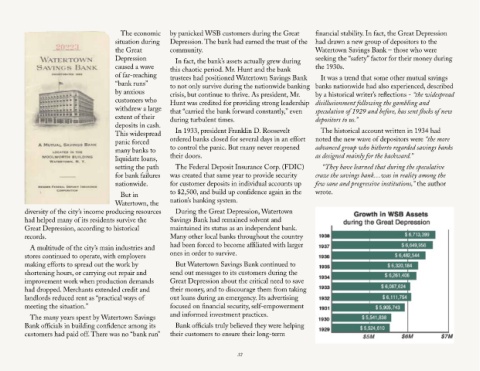

The economic by panicked WSB customers during the Great financial stability. In fact, the Great Depression

situation during Depression. The bank had earned the trust of the had drawn a new group of depositors to the

the Great community. Watertown Savings Bank – those who were

Depression In fact, the bank’s assets actually grew during seeking the “safety” factor for their money during

caused a wave this chaotic period. Mr. Hunt and the bank the 1930s.

of far-reaching trustees had positioned Watertown Savings Bank It was a trend that some other mutual savings

“bank runs” to not only survive during the nationwide banking banks nationwide had also experienced, described

by anxious crisis, but continue to thrive. As president, Mr. by a historical writer’s reflections - “the widespread

customers who Hunt was credited for providing strong leadership disillusionment following the gambling and

withdrew a large that “carried the bank forward constantly,” even speculation of 1929 and before, has sent flocks of new

extent of their during turbulent times. depositors to us.”

deposits in cash.

This widespread In 1933, president Franklin D. Roosevelt The historical account written in 1934 had

panic forced ordered banks closed for several days in an effort noted the new wave of depositors were “the more

many banks to to control the panic. But many never reopened advanced group who hitherto regarded savings banks

liquidate loans, their doors. as designed mainly for the backward.”

setting the path The Federal Deposit Insurance Corp. (FDIC) “They have learned that during the speculative

for bank failures was created that same year to provide security craze the savings bank…was in reality among the

nationwide. for customer deposits in individual accounts up few sane and progressive institutions,” the author

But in to $2,500, and build up confidence again in the wrote.

Watertown, the nation’s banking system.

diversity of the city’s income producing resources During the Great Depression, Watertown

had helped many of its residents survive the Savings Bank had remained solvent and

Great Depression, according to historical maintained its status as an independent bank.

records. Many other local banks throughout the country

A multitude of the city’s main industries and had been forced to become affiliated with larger

stores continued to operate, with employers ones in order to survive.

making efforts to spread out the work by But Watertown Savings Bank continued to

shortening hours, or carrying out repair and send out messages to its customers during the

improvement work when production demands Great Depression about the critical need to save

had dropped. Merchants extended credit and their money, and to discourage them from taking

landlords reduced rent as “practical ways of out loans during an emergency. Its advertising

meeting the situation.” focused on financial security, self-empowerment

The many years spent by Watertown Savings and informed investment practices.

Bank officials in building confidence among its Bank officials truly believed they were helping

customers had paid off. There was no “bank run” their customers to ensure their long-term

32