Page 51 - pwc-lease-accounting-guide_Neat

P. 51

Scope

See LG 3 for considerations for applying this practical expedient when assessing lease classification.

See LG 10 for further discussion of applying this practical expedient during transition.

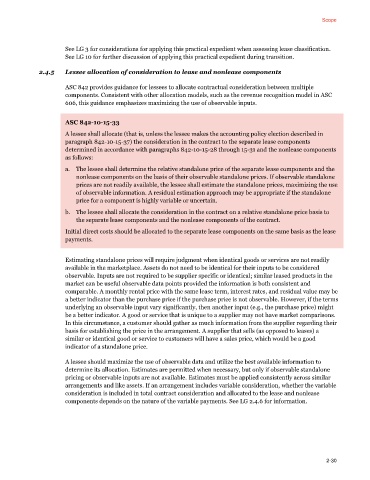

2.4.5 Lessee allocation of consideration to lease and nonlease components

ASC 842 provides guidance for lessees to allocate contractual consideration between multiple

components. Consistent with other allocation models, such as the revenue recognition model in ASC

606, this guidance emphasizes maximizing the use of observable inputs.

ASC 842-10-15-33

A lessee shall allocate (that is, unless the lessee makes the accounting policy election described in

paragraph 842-10-15-37) the consideration in the contract to the separate lease components

determined in accordance with paragraphs 842-10-15-28 through 15-31 and the nonlease components

as follows:

a. The lessee shall determine the relative standalone price of the separate lease components and the

nonlease components on the basis of their observable standalone prices. If observable standalone

prices are not readily available, the lessee shall estimate the standalone prices, maximizing the use

of observable information. A residual estimation approach may be appropriate if the standalone

price for a component is highly variable or uncertain.

b. The lessee shall allocate the consideration in the contract on a relative standalone price basis to

the separate lease components and the nonlease components of the contract.

Initial direct costs should be allocated to the separate lease components on the same basis as the lease

payments.

Estimating standalone prices will require judgment when identical goods or services are not readily

available in the marketplace. Assets do not need to be identical for their inputs to be considered

observable. Inputs are not required to be supplier specific or identical; similar leased products in the

market can be useful observable data points provided the information is both consistent and

comparable. A monthly rental price with the same lease term, interest rates, and residual value may be

a better indicator than the purchase price if the purchase price is not observable. However, if the terms

underlying an observable input vary significantly, then another input (e.g., the purchase price) might

be a better indicator. A good or service that is unique to a supplier may not have market comparisons.

In this circumstance, a customer should gather as much information from the supplier regarding their

basis for establishing the price in the arrangement. A supplier that sells (as opposed to leases) a

similar or identical good or service to customers will have a sales price, which would be a good

indicator of a standalone price.

A lessee should maximize the use of observable data and utilize the best available information to

determine its allocation. Estimates are permitted when necessary, but only if observable standalone

pricing or observable inputs are not available. Estimates must be applied consistently across similar

arrangements and like assets. If an arrangement includes variable consideration, whether the variable

consideration is included in total contract consideration and allocated to the lease and nonlease

components depends on the nature of the variable payments. See LG 2.4.6 for information.

2-30