Page 210 - KRCL ENglish

P. 210

st

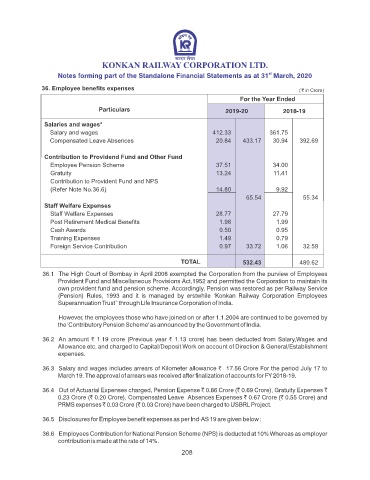

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

36. Employee benets expenses

2019-20 2018-19

Salaries and wages*

Salary and wages 412.33 361.75

Compensated Leave Absences 20.84 433.17 30.94 392.69

Contribution to Providend Fund and Other Fund

Employee Pension Scheme 37.51 34.00

Gratuity 13.24 11.41

Contribution to Provident Fund and NPS

(Refer Note No.36.6) 14.80 9.92

65.54 55.34

Staff Welfare Expenses

Staff Welfare Expenses 28.77 27.79

Post Retirement Medical Benets 1.98 1.99

Cash Awards 0.50 0.95

Training Expenses 1.49 0.79

Foreign Service Contribution 0.97 33.72 1.06 32.59

TOTAL 532.43 480.62

36.1 The High Court of Bombay in April 2008 exempted the Corporation from the purview of Employees

Provident Fund and Miscellaneous Provisions Act,1952 and permitted the Corporation to maintain its

own provident fund and pension scheme. Accordingly, Pension was restored as per Railway Service

(Pension) Rules, 1993 and it is managed by erstwhile ‘Konkan Railway Corporation Employees

Superannuation Trust” through Life Insurance Corporation of India.

However, the employees those who have joined on or after 1.1.2004 are continued to be governed by

the 'Contributory Pension Scheme' as announced by the Government of India.

36.2 An amount ` 1.19 crore (Previous year ` 1.13 crore) has been deducted from Salary,Wages and

Allowance etc. and charged to Capital/Deposit Work on account of Direction & General/Establishment

expenses.

36.3 Salary and wages includes arrears of Kilometer allowance ` 17.56 Crore For the period July 17 to

March 19. The approval of arrears was received after nalization of accounts for FY 2018-19.

36.4 Out of Actuarial Expenses charged, Pension Expense ` 0.86 Crore (` 0.69 Crore), Gratuity Expenses `

0.23 Crore (` 0.20 Crore), Compensated Leave Absences Expenses ` 0.67 Crore (` 0.55 Crore) and

PRMS expenses ` 0.03 Crore (` 0.03 Crore) have been charged to USBRL Project.

36.5 Disclosures for Employee benet expenses as per Ind-AS 19 are given below :

36.6 Employees Contribution for National Pension Scheme (NPS) is deducted at 10% Whereas as employer

contribution is made at the rate of 14%.

208