Page 214 - KRCL ENglish

P. 214

st

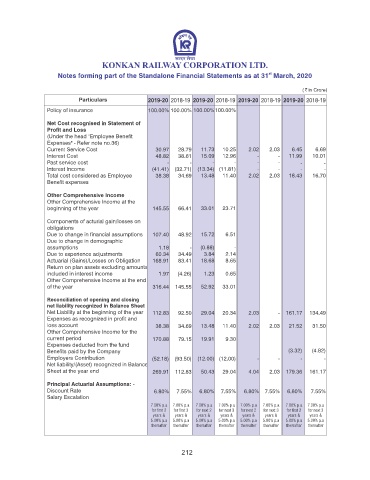

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

2019-20 2018-19 2019-20 2018-19 2019-20 2018-19 2019-20 2018-19

Policy of insurance 100.00% 100.00% 100.00%100.00%

Net Cost recognised in Statement of

Prot and Loss

(Under the head "Employee Benet

Expenses" - Refer note no.36)

Current Service Cost 30.97 28.79 11.73 10.25 2.02 2.03 6.45 6.69

Interest Cost 48.82 38.61 15.09 12.96 - - 11.99 10.01

Past service cost - - - - - - - -

Interest Income (41.41) (32.71) (13.34) (11.81) - - - -

Total cost considered as Employee 38.38 34.69 13.48 11.40 2.02 2.03 18.43 16.70

Benet expenses

Other Comprehensive Income

Other Comprehensive Income at the

beginning of the year 145.55 66.41 33.01 23.71

Components of acturial gain/losses on

obligations

Due to change in nancial assumptions 107.40 48.92 15.72 6.51

Due to change in demographic

assumptions 1.18 - (0.88) -

Due to experience adjustments 60.34 34.49 3.84 2.14

Actuarial (Gains)/Losses on Obligation 168.91 83.41 18.68 8.65

Return on plan assets excluding amounts

included in interest income 1.97 (4.26) 1.23 0.65

Other Comprehensive Income at the end

of the year 316.44 145.55 52.92 33.01

Reconciliation of opening and closing

net liability recognized in Balance Sheet

Net Liability at the beginning of the year 112.83 92.50 29.04 20.34 2.03 - 161.17 134.49

Expenses as recognized in prot and

loss account 38.38 34.69 13.48 11.40 2.02 2.03 21.52 31.50

Other Comprehensive Income for the

current period 170.88 79.15 19.91 9.30

Expenses deducted from the fund

Benets paid by the Company (3.32) (4.82)

Employers Contribution (52.18) (93.50) (12.00) (12.00) - - - -

Net liability/(Asset) recognized in Balance

Sheet at the year end 269.91 112.83 50.43 29.04 4.04 2.03 179.36 161.17

Principal Actuarial Assumptions: -

Discount Rate 6.80% 7.55% 6.80% 7.55% 6.80% 7.55% 6.80% 7.55%

Salary Escalation

7.00% p.a 7.00% p.a 7.00% p.a 7.00% p.a 7.00% p.a 7.00% p.a 7.00% p.a 7.00% p.a

for rst 2 for rst 3 for next 2 for next 3 for next 2 for next 3 for rst 2 for next 3

years & years & years & years & years & years & years & years &

5.00% p.a 5.00% p.a 5.00% p.a 5.00% p.a 5.00% p.a 5.00% p.a 5.00% p.a 5.00% p.a

thereafter thereafter thereafter thereafter thereafter thereafter thereafter thereafter

212