Page 215 - KRCL ENglish

P. 215

st

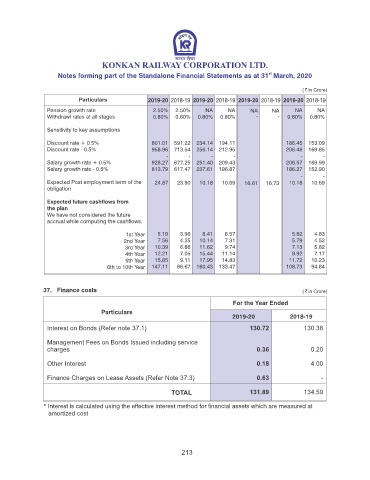

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

2019-20 2018-19 2019-20 2018-19 2019-20 2018-19 2019-20 2018-19

Pension growth rate 2.50% 2.50% NA NA NA NA NA NA

Withdrawl rates at all stages 0.80% 0.80% 0.80% 0.80% - - 0.80% 0.80%

Sensitivity to key assumptions

Discount rate + 0.5% 801.01 591.22 234.14 194.11 186.45 153.09

Discount rate - 0.5% 958.96 713.54 256.14 212.95 206.46 169.85

- - - - - -

Salary growth rate + 0.5% 928.27 677.25 251.40 209.43 206.57 169.99

Salary growth rate - 0.5% 813.79 617.47 237.61 196.87 186.27 152.90

- -

Expected Post employment term of the 24.87 23.90 10.18 10.69 16.61 16.73 10.18 10.69

obligation

Expected future cashows from

the plan

We have not considered the future

accrual while computing the cashows.

1st Year 5.19 3.96 8.41 6.57 5.82 4.83

2nd Year 7.56 4.25 10.14 7.31 5.79 4.52

3rd Year 10.39 6.86 11.62 9.74 7.13 5.82

4th Year 12.21 7.05 15.44 11.14 9.92 7.17

5th Year 15.85 9.11 17.95 14.83 11.72 10.23

6th to 10th Year 147.11 86.67 160.43 133.47 108.73 94.84

37. Finance costs

2019-20 2018-19

Interest on Bonds (Refer note 37.1) 130.72 130.38

Management Fees on Bonds Issued including service

charges 0.36 0.20

Other Interest 0.18 4.00

Finance Charges on Lease Assets (Refer Note 37.3) 0.63 -

TOTAL 131.89 134.59

* Interest is calculated using the effective interest method for nancial assets which are measured at

amortized cost

213