Page 211 - KRCL ENglish

P. 211

st

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

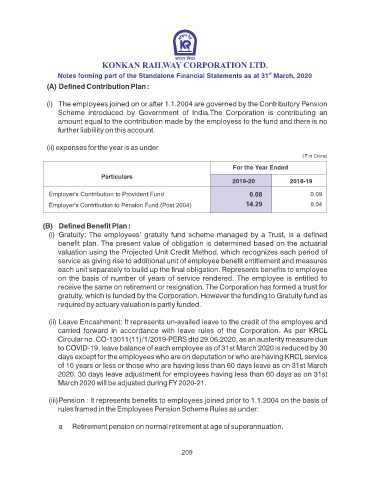

(A) Dened Contribution Plan :

(i) The employees joined on or after 1.1.2004 are governed by the Contributory Pension

Scheme introduced by Government of India.The Corporation is contributing an

amount equal to the contribution made by the employess to the fund and there is no

further liablility on this account.

(ii) expenses for the year is as under

2019-20 2018-19

0.08 0.09

14.29 9.04

(B) Dened Benet Plan :

(i) Gratuity: The employees’ gratuity fund scheme managed by a Trust, is a dened

benet plan. The present value of obligation is determined based on the actuarial

valuation using the Projected Unit Credit Method, which recognizes each period of

service as giving rise to additional unit of employee benet entitlement and measures

each unit separately to build up the nal obligation. Represents benets to employee

on the basis of number of years of service rendered. The employee is entitled to

receive the same on retirement or resignation. The Corporation has formed a trust for

gratuity, which is funded by the Corporation. However the funding to Gratuity fund as

required by actuary valuation is partly funded.

(ii) Leave Encashment: It represents un-availed leave to the credit of the employee and

carried forward in accordance with leave rules of the Corporation. As per KRCL

Circular no. CO-13011(11)/1/2019-PERS dtd 29.06.2020, as an austerity measure due

to COVID-19, leave balance of each employee as of 31st March 2020 is reduced by 30

days except for the employees who are on deputation or who are having KRCL service

of 10 years or less or those who are having less than 60 days leave as on 31st March

2020. 30 days leave adjustment for employees having less than 60 days as on 31st

March 2020 will be adjusted during FY 2020-21.

(iii) Pension : It represents benets to employees joined prior to 1.1.2004 on the basis of

rules framed in the Employees Pension Scheme Rules as under:

a Retirement pension on normal retirement at age of superannuation.

209