Page 235 - KRCL ENglish

P. 235

st

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

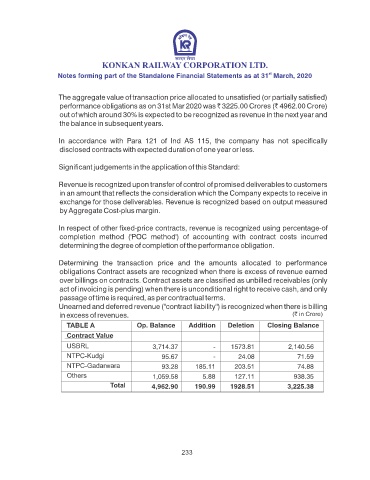

The aggregate value of transaction price allocated to unsatised (or partially satised)

performance obligations as on 31st Mar 2020 was ` 3225.00 Crores (` 4962.00 Crore)

out of which around 30% is expected to be recognized as revenue in the next year and

the balance in subsequent years.

In accordance with Para 121 of Ind AS 115, the company has not specically

disclosed contracts with expected duration of one year or less.

Signicant judgements in the application of this Standard:

Revenue is recognized upon transfer of control of promised deliverables to customers

in an amount that reects the consideration which the Company expects to receive in

exchange for those deliverables. Revenue is recognized based on output measured

by Aggregate Cost-plus margin.

In respect of other xed-price contracts, revenue is recognized using percentage-of

completion method ('POC method') of accounting with contract costs incurred

determining the degree of completion of the performance obligation.

Determining the transaction price and the amounts allocated to performance

obligations Contract assets are recognized when there is excess of revenue earned

over billings on contracts. Contract assets are classied as unbilled receivables (only

act of invoicing is pending) when there is unconditional right to receive cash, and only

passage of time is required, as per contractual terms.

Unearned and deferred revenue ("contract liability") is recognized when there is billing

in excess of revenues.

3,714.37 - 1573.81 2,140.56

95.67 - 24.08 71.59

93.28 185.11 203.51 74.88

1,059.58 5.88 127.11 938.35

4,962.90 190.99 1928.51 3,225.38

233