Page 233 - KRCL ENglish

P. 233

st

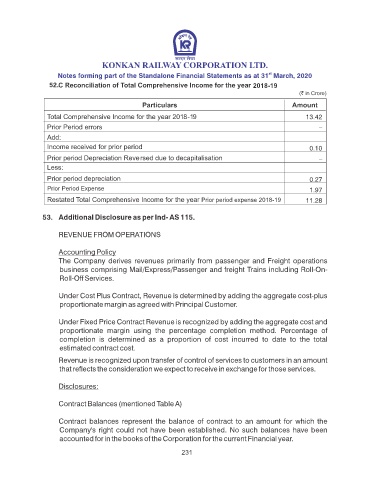

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

52. 2018-19

13.42

–

0.10

–

0.27

Prior Period Expense 1.97

Prior period expense 2018-19 11.28

53. Additional Disclosure as per Ind- AS 115.

REVENUE FROM OPERATIONS

Accounting Policy

The Company derives revenues primarily from passenger and Freight operations

business comprising Mail/Express/Passenger and freight Trains including Roll-On-

Roll-Off Services.

Under Cost Plus Contract, Revenue is determined by adding the aggregate cost-plus

proportionate margin as agreed with Principal Customer.

Under Fixed Price Contract Revenue is recognized by adding the aggregate cost and

proportionate margin using the percentage completion method. Percentage of

completion is determined as a proportion of cost incurred to date to the total

estimated contract cost.

Revenue is recognized upon transfer of control of services to customers in an amount

that reects the consideration we expect to receive in exchange for those services.

Disclosures:

Contract Balances (mentioned Table A)

Contract balances represent the balance of contract to an amount for which the

Company's right could not have been established. No such balances have been

accounted for in the books of the Corporation for the current Financial year.

231