Page 231 - KRCL ENglish

P. 231

st

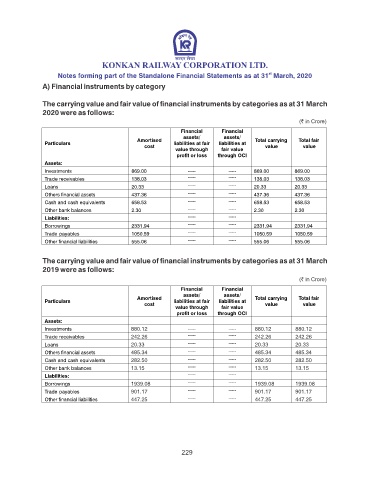

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

A) Financial instruments by category

The carrying value and fair value of nancial instruments by categories as at 31 March

2020 were as follows:

Financial Financial

assets/ assets/

Amortised Total carrying Total fair

Particulars liabilities at fair liabilities at

cost value value

value through fair value

prot or loss through OCI

Assets:

Investments 869.00 ----- ----- 869.00 869.00

Trade receivables 138.03 ----- ----- 138.03 138.03

Loans 20.33 ----- ----- 20.33 20.33

Others nancial assets 437.36 ----- ----- 437.36 437.36

Cash and cash equivalents 658.53 ----- ----- 658.53 658.53

Other bank balances 2.30 ----- ----- 2.30 2.30

Liabilities: ----- -----

Borrowings 2331.94 ----- ----- 2331.94 2331.94

Trade payables 1050.59 ----- ----- 1050.59 1050.59

Other nancial liabilities 555.06 ----- ----- 555.06 555.06

The carrying value and fair value of nancial instruments by categories as at 31 March

2019 were as follows:

Financial Financial

assets/ assets/

Amortised Total carrying Total fair

Particulars liabilities at fair liabilities at

cost value value

value through fair value

prot or loss through OCI

Assets:

Investments 880.12 ----- ----- 880.12 880.12

Trade receivables 242.26 ----- ----- 242.26 242.26

Loans 20.33 ----- ----- 20.33 20.33

Others nancial assets 485.34 ----- ----- 485.34 485.34

Cash and cash equivalents 282.50 ----- ----- 282.50 282.50

----- -----

Other bank balances 13.15 13.15 13.15

Liabilities: ----- -----

Borrowings 1939.08 ----- ----- 1939.08 1939.08

Trade payables 901.17 ----- ----- 901.17 901.17

Other nancial liabilities 447.25 ----- ----- 447.25 447.25

229