Page 227 - KRCL ENglish

P. 227

st

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

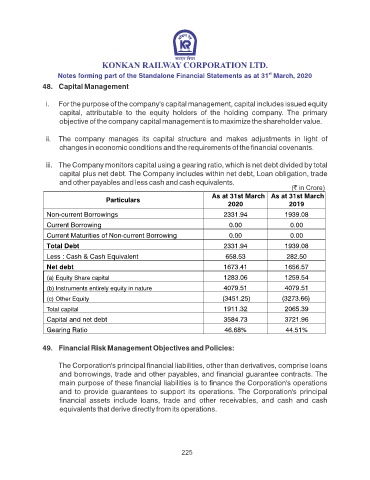

48. Capital Management

i. For the purpose of the company's capital management, capital includes issued equity

capital, attributable to the equity holders of the holding company. The primary

objective of the company capital management is to maximize the shareholder value.

ii. The company manages its capital structure and makes adjustments in light of

changes in economic conditions and the requirements of the nancial covenants.

iii. The Company monitors capital using a gearing ratio, which is net debt divided by total

capital plus net debt. The Company includes within net debt, Loan obligation, trade

and other payables and less cash and cash equivalents.

As at 31st March As at 31st March

Particulars

2020 2019

Non-current Borrowings 2331.94 1939.08

Current Borrowing 0.00 0.00

Current Maturities of Non-current Borrowing 0.00 0.00

Total Debt 2331.94 1939.08

Less : Cash & Cash Equivalent 658.53 282.50

Net debt 1673.41 1656.57

(a) Equity Share capital 1283.06 1259.54

(b) Instruments entirely equity in nature 4079.51 4079.51

(c) Other Equity (3451.25) (3273.66)

Total capital 1911.32 2065.39

Capital and net debt 3584.73 3721.96

Gearing Ratio 46.68% 44.51%

49. Financial Risk Management Objectives and Policies:

The Corporation's principal nancial liabilities, other than derivatives, comprise loans

and borrowings, trade and other payables, and nancial guarantee contracts. The

main purpose of these nancial liabilities is to nance the Corporation's operations

and to provide guarantees to support its operations. The Corporation's principal

nancial assets include loans, trade and other receivables, and cash and cash

equivalents that derive directly from its operations.

225