Page 228 - KRCL ENglish

P. 228

st

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

Credit risk:

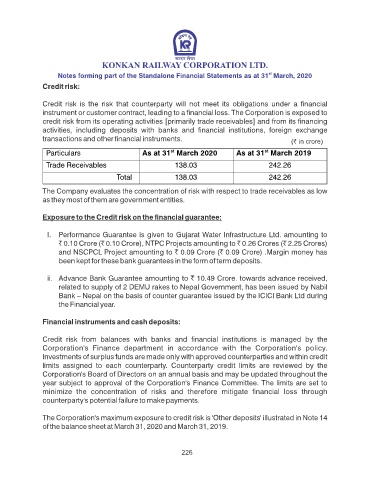

Credit risk is the risk that counterparty will not meet its obligations under a nancial

instrument or customer contract, leading to a nancial loss. The Corporation is exposed to

credit risk from its operating activities [primarily trade receivables] and from its nancing

activities, including deposits with banks and nancial institutions, foreign exchange

transactions and other nancial instruments. (` in crore)

st

st

Particulars As at 31 March 2020 As at 31 March 2019

Trade Receivables 138.03 242.26

Total 138.03 242.26

The Company evaluates the concentration of risk with respect to trade receivables as low

as they most of them are government entities.

Exposure to the Credit risk on the nancial guarantee:

I. Performance Guarantee is given to Gujarat Water Infrastructure Ltd. amounting to

` 0.10 Crore (` 0.10 Crore), NTPC Projects amounting to ` 0.26 Crores (` 2.25 Crores)

and NSCPCL Project amounting to ` 0.09 Crore (` 0.09 Crore) .Margin money has

been kept for these bank guarantees in the form of term deposits.

ii. Advance Bank Guarantee amounting to ` 10.49 Crore. towards advance received,

related to supply of 2 DEMU rakes to Nepal Government, has been issued by Nabil

Bank – Nepal on the basis of counter guarantee issued by the ICICI Bank Ltd during

the Financial year.

Financial instruments and cash deposits:

Credit risk from balances with banks and nancial institutions is managed by the

Corporation's Finance department in accordance with the Corporation's policy.

Investments of surplus funds are made only with approved counterparties and within credit

limits assigned to each counterparty. Counterparty credit limits are reviewed by the

Corporation's Board of Directors on an annual basis and may be updated throughout the

year subject to approval of the Corporation's Finance Committee. The limits are set to

minimize the concentration of risks and therefore mitigate nancial loss through

counterparty's potential failure to make payments.

The Corporation's maximum exposure to credit risk is 'Other deposits' illustrated in Note 14

of the balance sheet at March 31, 2020 and March 31, 2019.

226