Page 230 - KRCL ENglish

P. 230

st

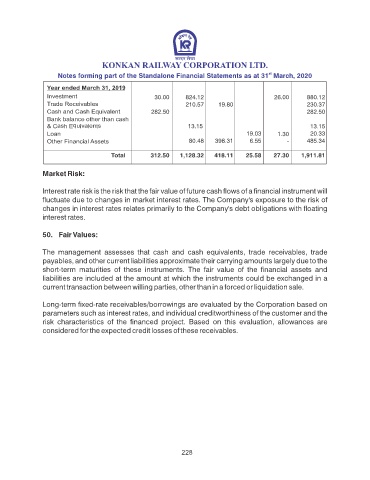

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

2019

30.00 824.12 26.00 880.12

210.57 19.80 230.37

282.50 282.50

13.15 13.15

19.03 1.30 20.33

80.48 398.31 6.55 - 485.34

312.50 1,128.32 418.11 25.58 27.30 1,911.81

Market Risk:

Interest rate risk is the risk that the fair value of future cash ows of a nancial instrument will

uctuate due to changes in market interest rates. The Company's exposure to the risk of

changes in interest rates relates primarily to the Company's debt obligations with oating

interest rates.

50. Fair Values:

The management assesses that cash and cash equivalents, trade receivables, trade

payables, and other current liabilities approximate their carrying amounts largely due to the

short-term maturities of these instruments. The fair value of the nancial assets and

liabilities are included at the amount at which the instruments could be exchanged in a

current transaction between willing parties, other than in a forced or liquidation sale.

Long-term xed-rate receivables/borrowings are evaluated by the Corporation based on

parameters such as interest rates, and individual creditworthiness of the customer and the

risk characteristics of the nanced project. Based on this evaluation, allowances are

considered for the expected credit losses of these receivables.

228